Bajaj Auto Ltd, India’s second-largest motorcycle manufacturer, today announced the launch of its electric scooter — Chetak. This will be Chetak’s second innings in the scooter segment, almost after a decade’s gap. Bajaj stopped manufacturing traditional scooters around 2009 in order to focus on motorcycles and it has been working on this electric scooter for over 5 years now. According to Rajiv Bajaj, managing director of Bajaj Auto, there is immense potential for scooters and three-wheelers in the electric space.

Will this provide stock prices the required electric spark to perform?

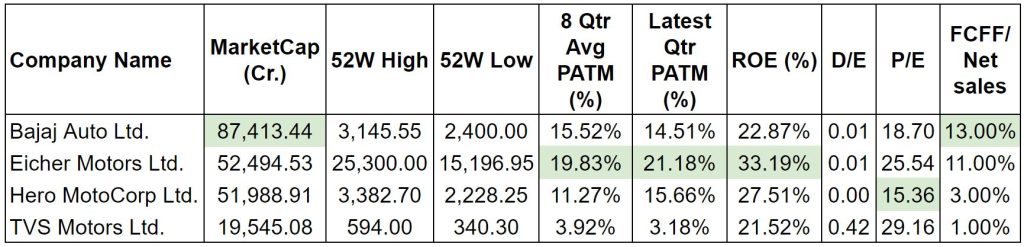

Let’s look at how Bajaj is placed among its peers when it comes to operational performance.

Bajaj with the highest market cap is India’s second-largest motorcycle manufacturer. Following observations can be made from the above table:

- The latest quarter (June 2019) profit margins were slightly lower than the last 8 quarter’s average profit margins but has 2nd highest profit margins in the industry.

- Free Cash Flows to sales ratio being the highest in the industry shows that the quality of the earnings is strong.

- Company has Total debt on books (as on 31st March 2019) of ₹ 124 crore which is almost negligible as the cash in hand as on the same date was around ₹ 933 crore, showing that financial position is strong, which is also backed by the D/E ratio of 0.01.

- P/E ratio of around 18.7 times, when compared with the ROE of 22.87%, shows that the stock is reasonably priced at this point. (You can find the relation between P/E and ROE in our previous write-up )

On the Technical front, Bajaj Auto (NS:BAJA) broke out of a multi-year consolidating Symmetric Triangle. As this breakout has occurred within the 2/3rd length of this triangle, there is a very high probability of a substantial move on the upside. However, the first hurdle after this breakout could be at the levels around ₹3090 and crossing off that could lead the prices to touch previous all-time highs of around ₹3400 soon.

Bajaj Auto (NS:BAJA) will declare its Q2 results on 23rd Sep 2019, if there are no negative surprises then, with fundamentals and technicals backing the stock, Bajaj Auto could be a potential winner.

Disclaimer: Jamnadas Virji Advisory and its affiliates, partners, associates, and employees or its analysts did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with the preparation of the research documents. Accordingly, neither Jamnadas Virji Advisory nor Research Analysts have any material conflict of interest at the time of publication of the research documents. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. Jamnadas Virji Advisory may have issued other research documents that are inconsistent with and reach different conclusions from the information presented in any particular research document.

The research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the research documents.