The Real Reasons Behind the FII Sell-Off

FII Selling Spree: What’s Happening in Indian Stock Markets?

Foreign Institutional Investors (FIIs) currently hold a massive ₹70.92 lakh crore in Indian equities, representing 5% of the stock market. Yet, they have sold off 11.72% of their holdings recently. Is it political instability? Economic slowdown? No—it boils down to one key factor: returns.

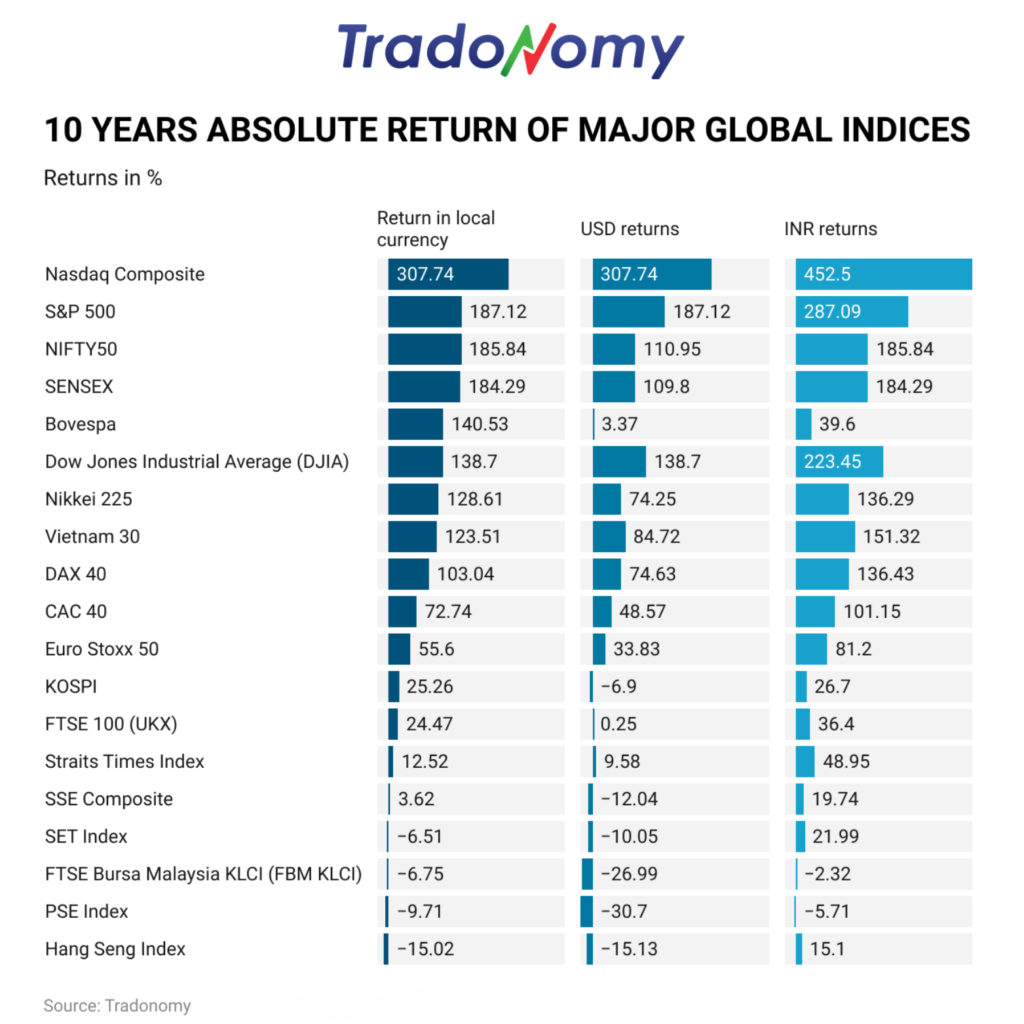

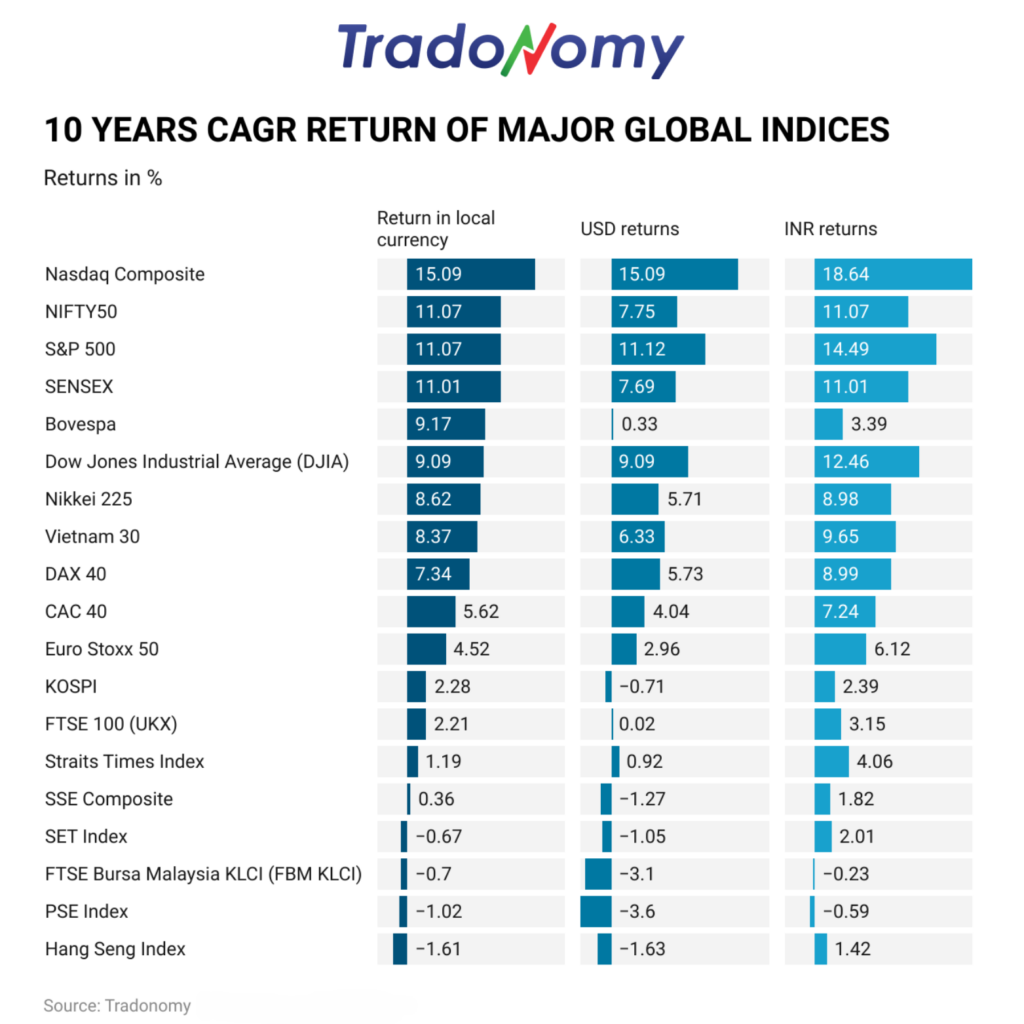

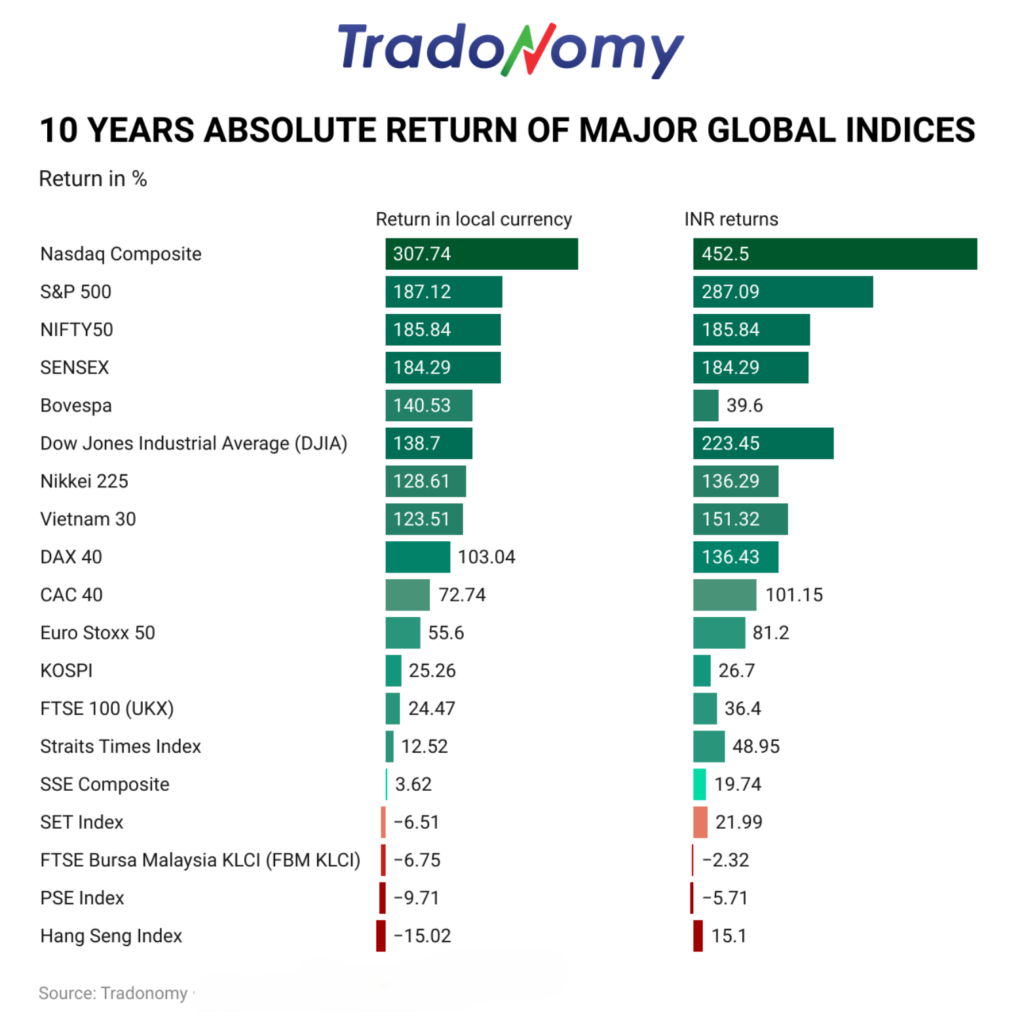

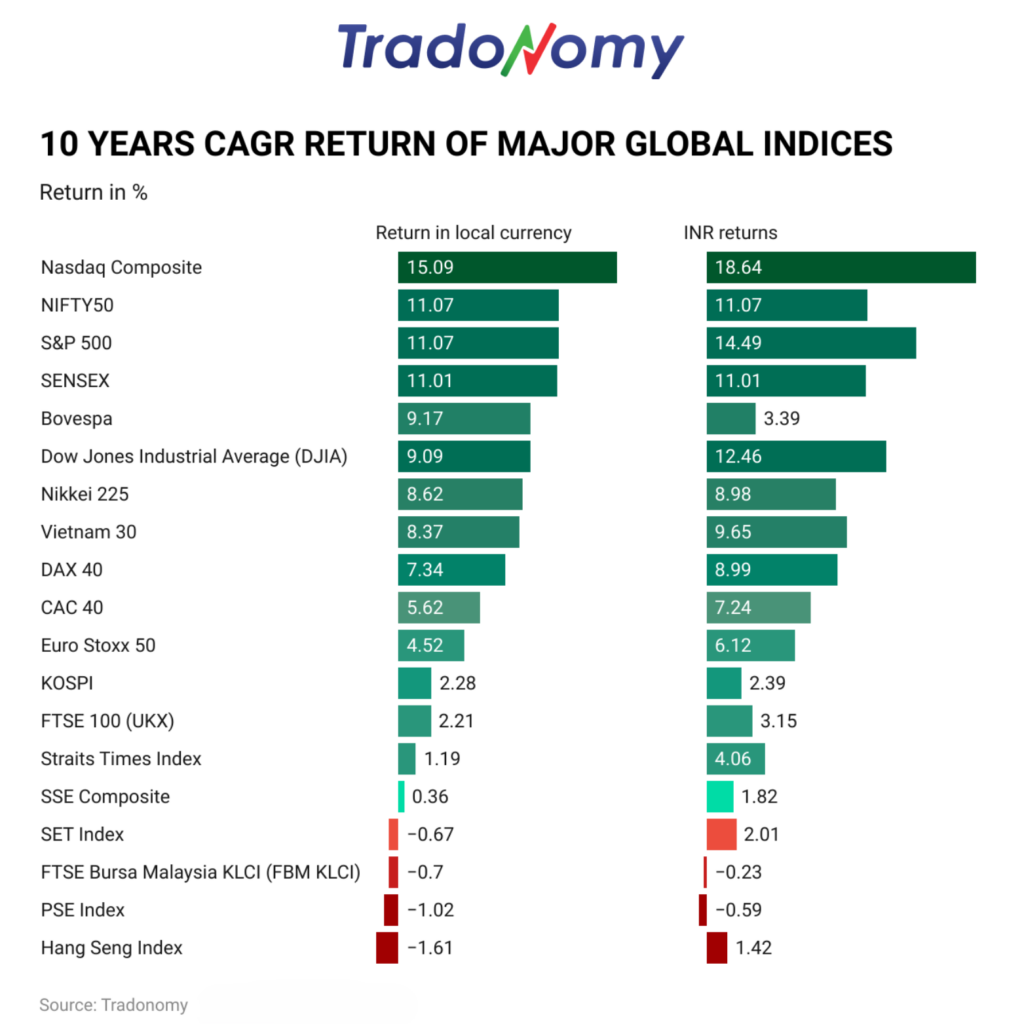

How Global Markets Have Performed Over the Past Decade (2015–2024)

If you were an FII with $1 million to invest globally, here’s how your portfolio would have grown:

Top-Performing Developed Markets:

– Nasdaq Composite: $1M ➔ $4M (Absolute Return: 307.74%, CAGR: 15.09%).

– S&P 500: $1M ➔ $2.87M (Absolute Return: 185.67%, CAGR: 11.12%).

– Dow Jones: $1M ➔ $2.39M (Absolute Return: 138.7%, CAGR: 9.09%).

Indian Markets:

– NIFTY50: $1M ➔ $2.1M (Absolute Return: 185.84% in INR, CAGR: 7.75% in USD).

– Sensex: $1M ➔ $2.09M (Absolute Return: 184.29% in INR, CAGR: 7.69% in USD).

Other Global Markets:

– Germany DAX: $1M ➔ $1.75M (CAGR: ~5.8%).

– Japan Nikkei: $1M ➔ $1.74M (CAGR: ~5.7%).

– Vietnam VN30: $1M ➔ $1.85M (CAGR: ~6.4%).

– China SSE Composite: $1M ➔ $880K (Negative Return).

India vs. Emerging Markets: A Mixed Bag

India’s NIFTY50 and Sensex outperformed most emerging markets, boasting ~11% CAGR in INR terms. However, despite rupee depreciation of 36.24% over the last decade, India’s markets have delivered better returns compared to most emerging markets in USD terms. Comparisons:

– Vietnam VN30: $1M ➔ $1.85M (6.4% CAGR in USD).

– China SSE Composite: $1M ➔ $880K (Negative Return).

– Philippines PSE Index: $1M ➔ $693K (Negative Return).

– Malaysia FBM KLCI: $1M ➔ $730K (Negative Return).

Key Insight: India leads among emerging markets, but its USD returns fail to compete with the U.S.The Role of Rupee Depreciation in FII Decisions

Over the past decade, the Indian Rupee has depreciated 36.24% against the USD, severely impacting FII returns. Here’s the effect:

– Sensex: 184.29% absolute return in INR ➔ 109.8% in USD.

– NIFTY50: 185.84% absolute return in INR ➔ 110.95% in USD.

Even with strong INR performance, FIIs lose value during currency conversion. In contrast, U.S. markets offer strong, stable USD returns.

The Shrinking Yield Spread: A Game-Changer

The gap between NIFTY50 returns and U.S. Treasury yields has narrowed, making Indian equities less attractive:

– NIFTY50 CAGR: 7.75%.

– U.S. Treasury Yields: ~5%.

– Historical India-to-U.S. spread: 5–7%.

– Current spread: ~3%.

FIIs are increasingly opting for safer U.S. treasuries or domestic markets with higher returns.

Indian Investors Reaping Global Rewards

For Indian investors that would’ve invested $1 Million in the US has paid off, thanks to rupee depreciation and overall better performance by US markets:

– Nasdaq Composite: $1M ➔ $5.52M in INR (35.63% currency boost).

– S&P 500: $1M ➔ $3.87M (34.84% currency boost).

– Dow Jones: $1M ➔ $3.23M (35.15% currency boost)

Even developed markets like Germany’s DAX (+136.43%) and Japan’s Nikkei (+136.29%) provided an extra 16–17% boost due to INR depreciation compared to average +74% returns for both Dax & Nikkei in USD.

Why FIIs Are Pulling Out of India

1. Higher Returns Elsewhere: Nasdaq (CAGR 15.09%) and S&P 500 (11.12%) offer better returns in USD.

2. Currency Stability: U.S. markets eliminate the risk of rupee depreciation.

3. Tighter Yield Spreads: NIFTY50’s 7.75% CAGR is only 3% above U.S. treasuries, compared to the historical 5–7% spread.

Conclusion: FIIs are reallocating funds to maximize returns—and U.S. markets offer a more attractive combination of growth and stability.

Pro Tip: Diversify Your Portfolio Globally

Indian investors can gain an edge by investing globally, particularly in U.S. markets like the Nasdaq and S&P 500. Take advantage of currency movements and the robust performance of these indices to grow your wealth.

Final Thought: Where Should You Invest $1 Million?

If it were 2015, would you bet on Indian markets with currency risks or the U.S. with its stellar returns? The answer is clear: U.S. markets dominate. Want to learn more about making the right investment moves? Stay tuned for more expert insights!