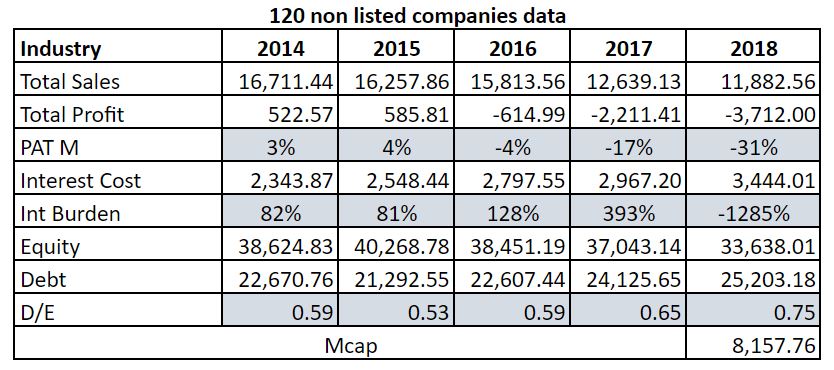

We have been reading a lot about stress in real estate sector. Here is an analysis of the sales, profits, profit margins and debt of around 182 companies, out of which 120 are those which are not listed. While only 62 that are listed companies saw some improvement in debt reduction.

In the below table it should be observed that Profit margins of those 120 companies deteriorated year over year. This is mainly due to very high debt compared to the earnings in addition to weak demand. If we calculate interest burden (i.e. interest as a % of profit before interest), it was as high as 82% five years back which shot up to 393% in recent years, leading to deep and unsustainable losses.

The financial creditors can initiate insolvency proceedings against a corporate debtor when it commits a ‘default’ . Recent supreme court ruling made home buyer’s position at par with financial creditors, which means that now aggrieved home buyers can also initiate insolvency proceedings against the defaulting builders, due to which most of these companies are awaiting resolution under IBC, 2016.

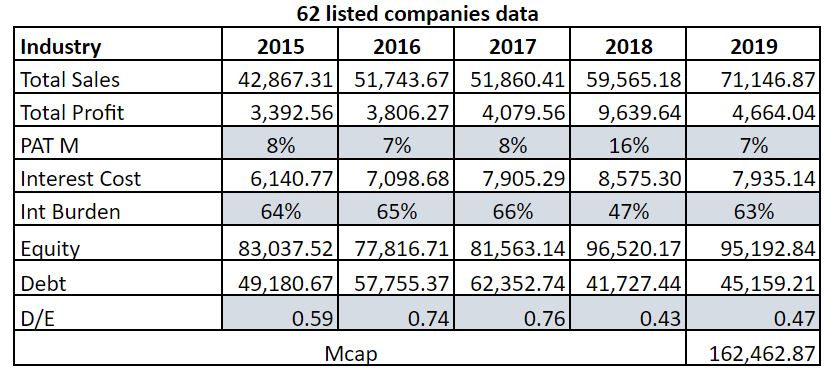

However, a very different trend could be observed from the aggregates of the companies that are into listed space. Aggregate data shows that these companies are able to cloak in higher sales. However, their profitability dropped in the last few years along with the margins which are consistent with the overall slowdown in this industry, the interest burden, and debt levels though reasonably high, have not gone up alarmingly. Out of these 62 companies, 44 companies were able to add value to the shareholder’s fund in the last 5 years.

This shows that big players are able to stay above the waters even in such stormy scenarios.