How to identify if the stock you chose to invest is available at a bargain price?

Answer to this question is no easy task. However, once you have established after a through research and understanding that the business is sound and will yield good returns, the question to ask is whether that good business is available at a good price?.

One way to make that judgement is by looking at the price to earnings (P/E) ratio. However, P/E ratio in itself will yield to incorrect conclusions. As laid down by arguably the greatest fund manager in history, Peter Lynch – Companies that have higher return on equity (ROE) and are able to maintain that higher ratio for several years, are generally the businesses that have some competitive advantage and can be assumed to do well in future. Another important point that he makes is that while buying shares of those companies, if P/E ratio is lower than the ROE, then you have come across a potential winner.

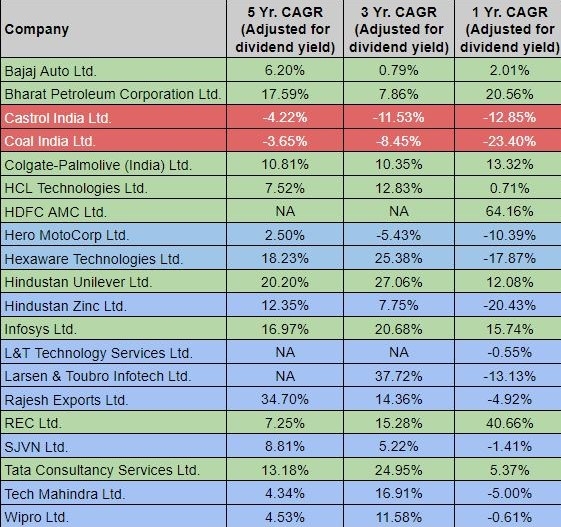

We at Tradonomy have compiled a list of the stocks where ROE is greater than P/E currently and was also at some point of the year for the past 5 years. We have excluded banks and NBFC as well as companies having market cap less than ₹10,000 Crore from this list.