Before putting our money on the front line, let us first get ourselves acquainted with the life insurance industry and some of the facts related to it.

- Gross Insurance premiums written in India were around ₹ 5.53 trillion in FY18.

- Life insurance premium out of above stands at around ₹ 4.58 trillion i.e 82.8% of overall premium.

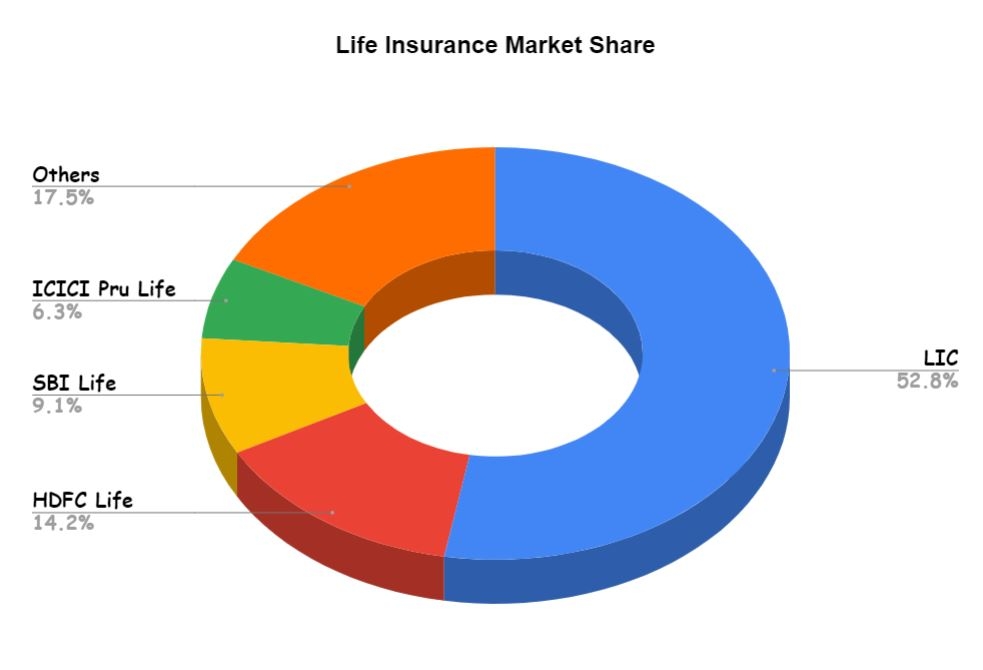

- Market share for private sector players (HDFC Life, SBI Life, ICICI Pru Life, etc.) in life insurance segment increased by 25.29% in 2019.

- New and innovative distribution channels like bancassurance, online distribution and NBFCs have widened the reach and has also helped in reducing the costs.

- Players in the industry are investing in Information Technology to automate various processes and cut costs without affecting service delivery. It is estimated that digitisation will reduce somewhere around 15-20 percent of total cost for life insurers.

- Overall growth in the financial industry along with the increase in working population having higher disposable income is leading to higher premiums paid by employers directly, which is another major growth driver for the insurance industry.

- Group insurance has also been a big driver of insurance growth in the country. Number of lives covered under private life insurance companies reached 36.20 million up to June 2018, showing year-on-year growth rate of 27.48 per cent.

- Insurance products are covered under the exempt, exempt, exempt (EEE) method of taxation. This translates to an effective tax benefit of approximately 30 per cent on select investments (including life insurance premiums) every financial year, thus encouraging people to buy life insurance.

- The opportunity to expand in the Indian life insurance industry remains sizeable as the protection gap has increased over 4x in the last 15 years with significantly low penetration and density. Overall in absolute terms, the protection gap identified is around $ 160 billion for the emerging nations, and just $ 2.5 billion for developed countries. Bangladesh leads the developing nations, which has the biggest gap in terms of under penetration, followed by India, Vietnam, the Philippines, Indonesia, Egypt and Nigeria.

- As per Swiss Re. Report, Life Insurance Penetration in India is about 2.76% of the GDP, compared to the 3.33% Global average.

- The life insurance sector in India is growing at 11 to 12 per cent.

However, there are three major challenges that the life insurance industry faces:

- The products offered by all the players in life insurance are homogenous (i.e they do not vary much with respect to the value or services offered to the insured) and hence creates a very competitive market where they lose pricing power.

- Indian insurance industry for private players is relatively new, it was in the year 2000 that private companies were allowed to do business in the life insurance segment. Thus the regulations are also new and unsettled which creates regulatory uncertainty.

- Growth in the life insurance sector in India is around 11-12%, while non-life insurance sector is growing at a healthy rate of around 18-20%, of which the health insurance segment’s average growth rate is around 35% per annum.

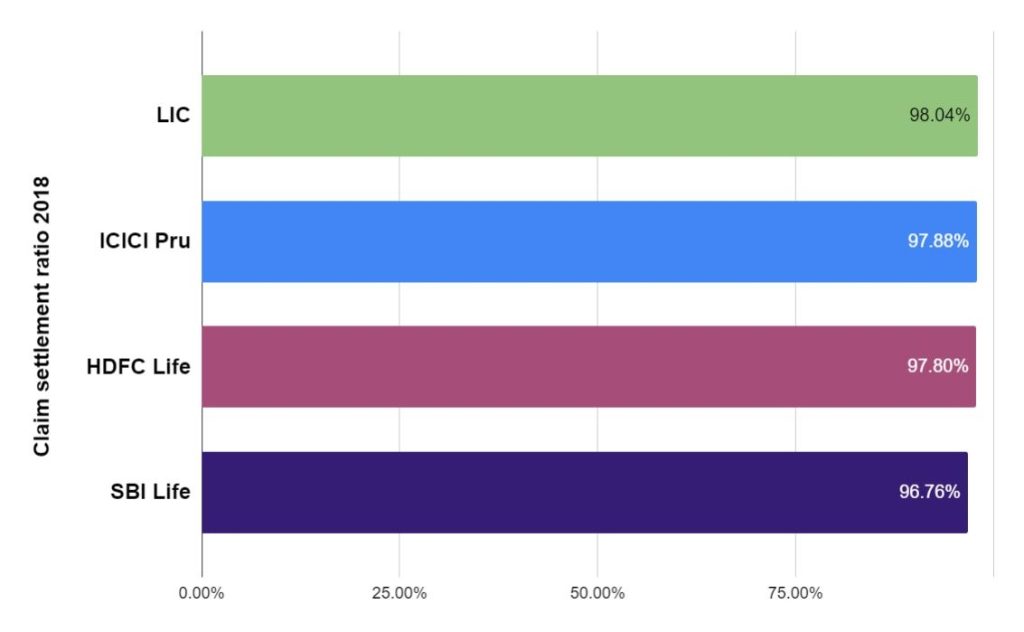

However, Only 3 life insurance companies (ICICI Prudential Life, SBI Life and HDFC Life) are listed on stock exchanges so as to give an opportunity to invest in them.

In our next post we will be listing out on how to evaluate the performance of an insurance company, so stay tuned.