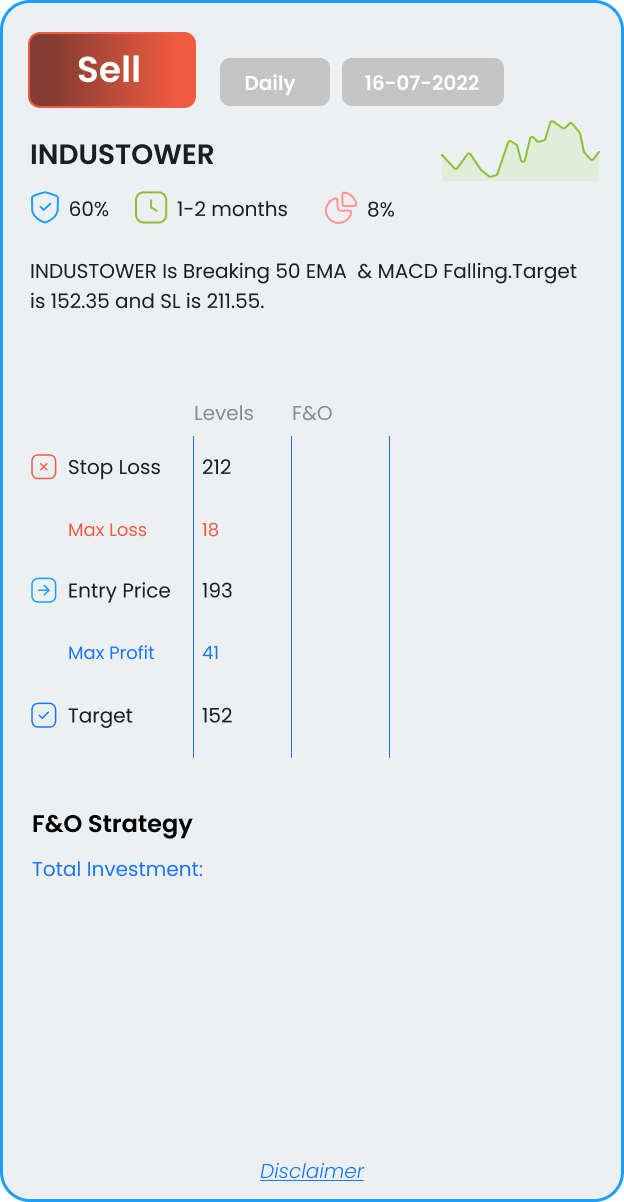

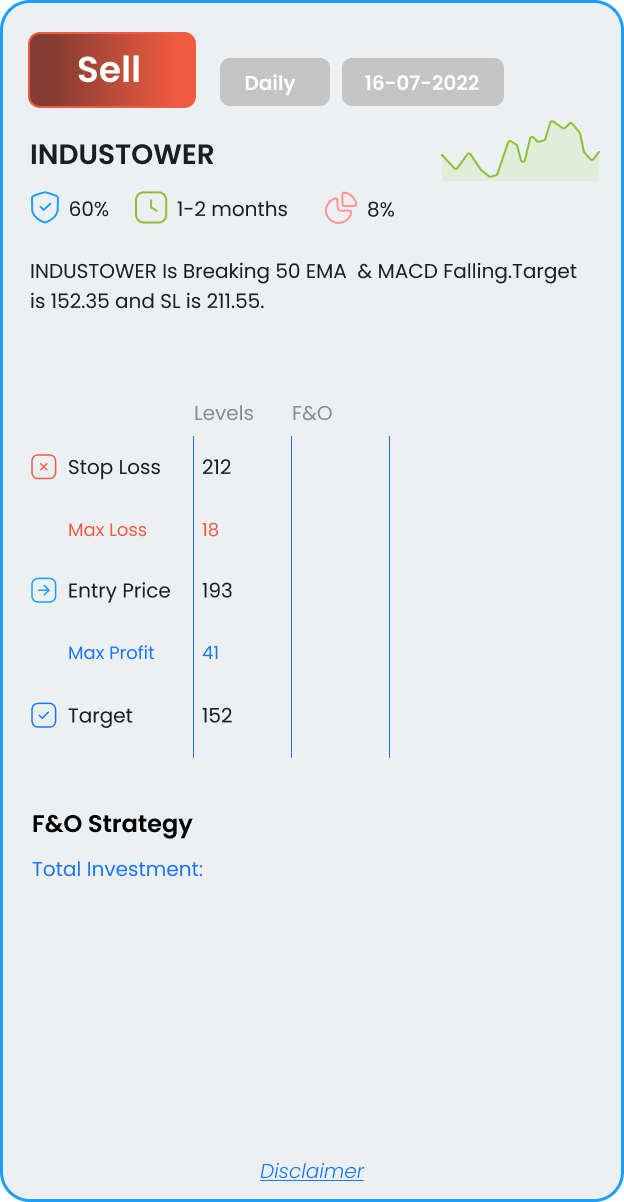

INDUSTOWER

Bharti Infratel Ltd Breaking 50 EMA & MACD Falling. Target is 152.35 and SL is 211.55.

Bharti Infratel Ltd Breaking 50 EMA & MACD Falling. Target is 152.35 and SL is 211.55.

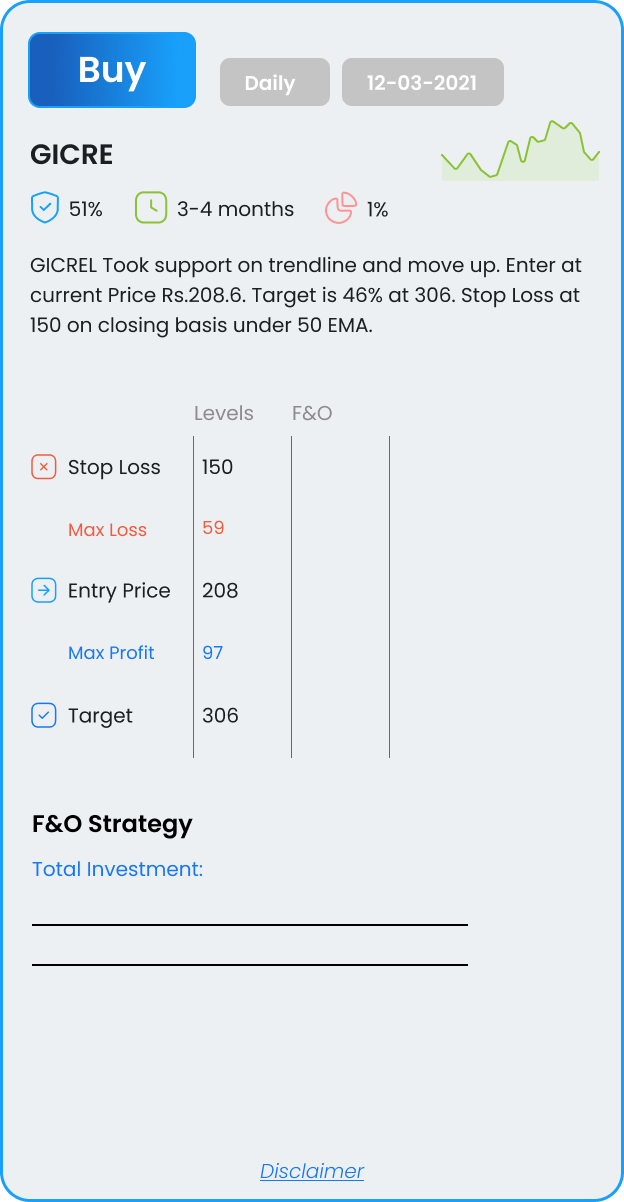

Took support on trendline and move up. Enter at the current Price of Rs.208.6. Target is 46% at 306. Stop Loss at 150 on a closing basis under 50 EMA.

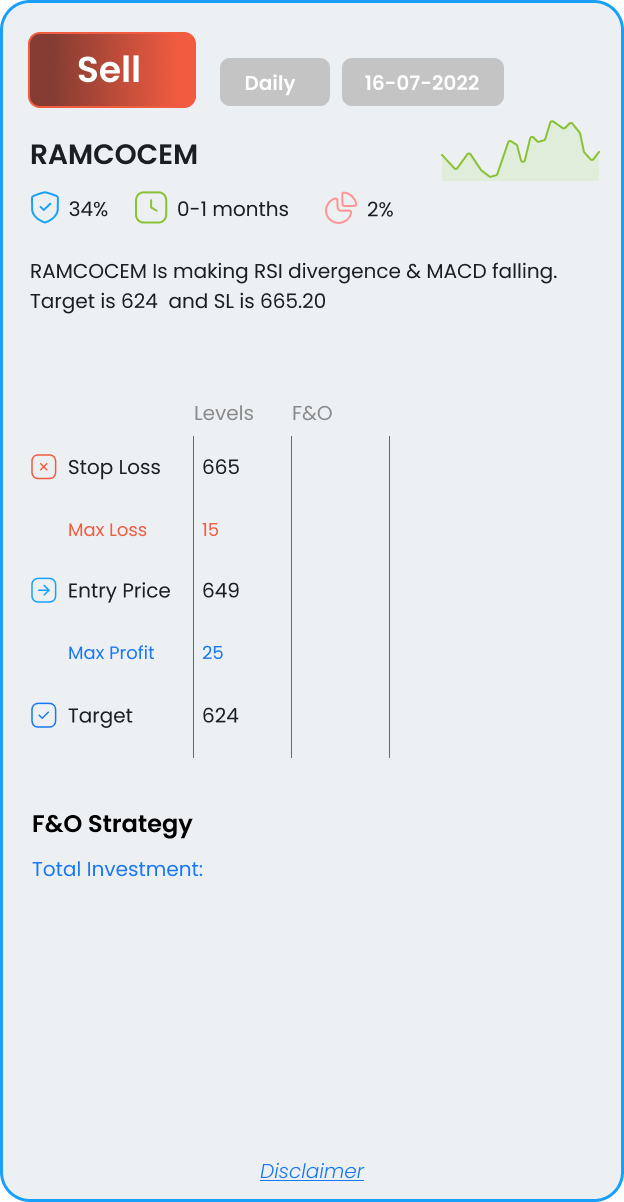

The Ramco Cements Ltd Making RSI divergence & MACD falling. Target is 624 and SL is 665.20

Breaking 50 EMA with RSI Divergence & MACD Falling. short at 264.3 with Stop Loss of 271.40 and first Target of 218.8

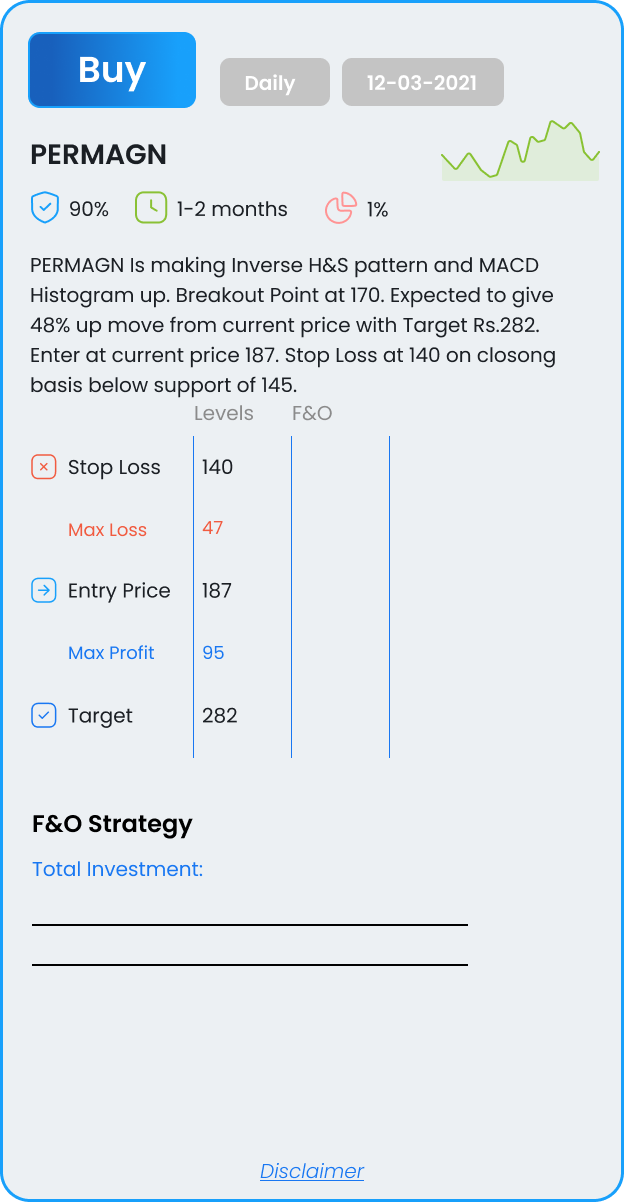

Is making Inverse H&S pattern and MACD Histogram up. Breakout Point at 170. Expected to give 48% up move from current price with Target Rs.282. Enter at current price 187. Stop Loss at 140 on a closing basis below the support of 145.

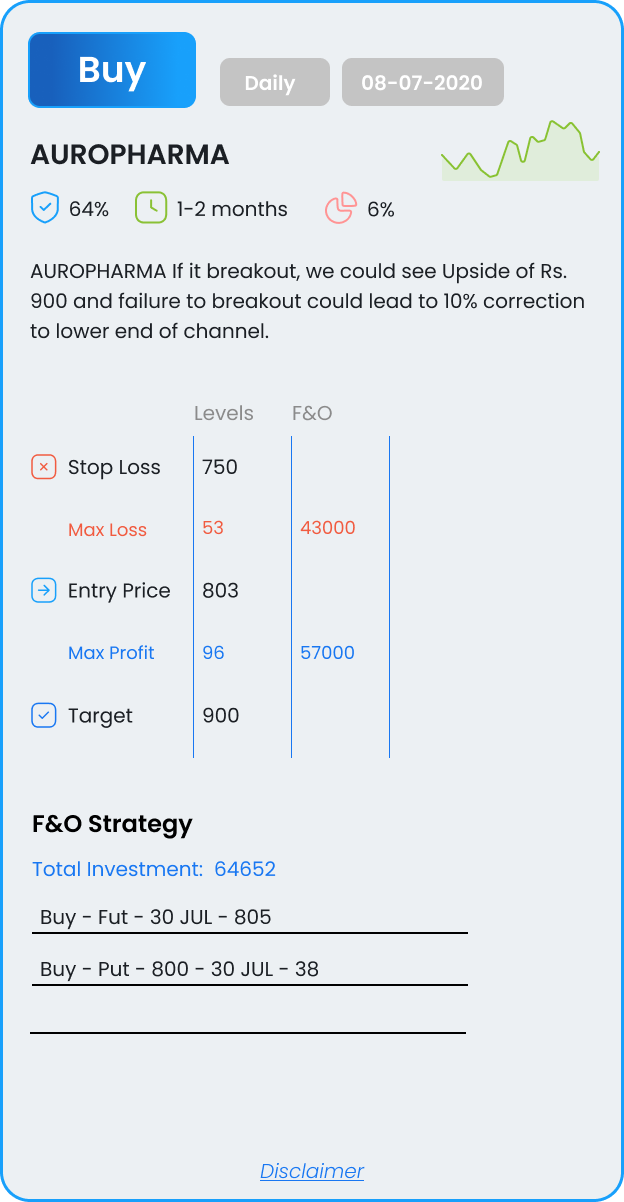

If it breakout, we could see Upside of Rs. 900 and failure to breakout could lead to 10% correction to lower end of channel.

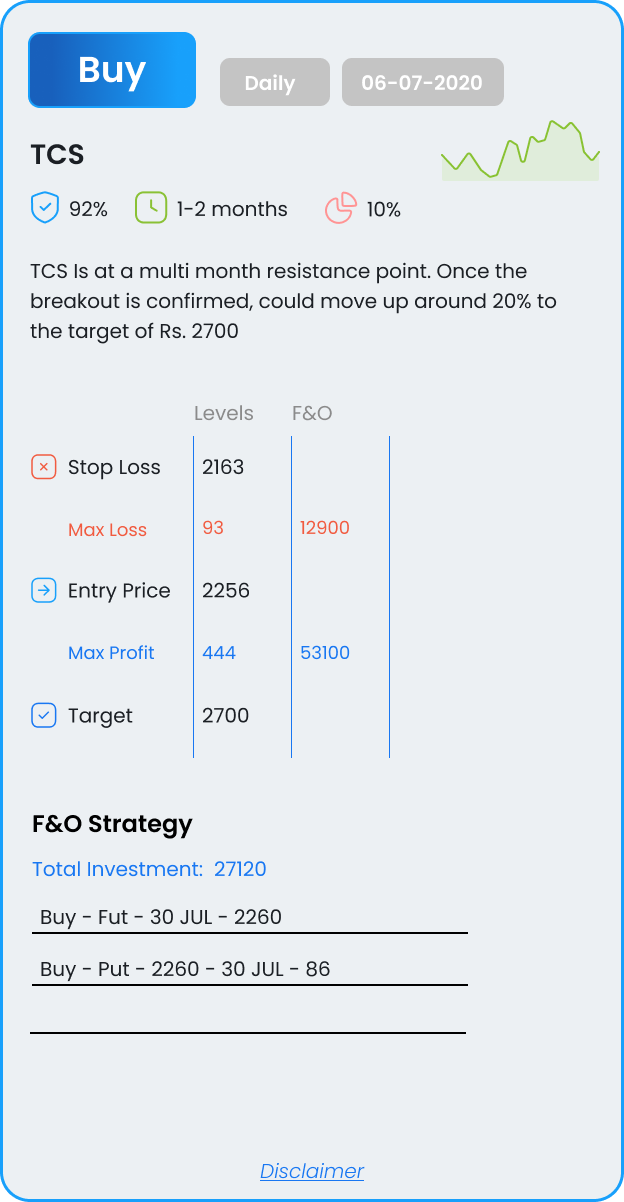

Is at a multi month resistance point. Once the breakout is confirmed, could move up around 20% to the target of Rs. 2700

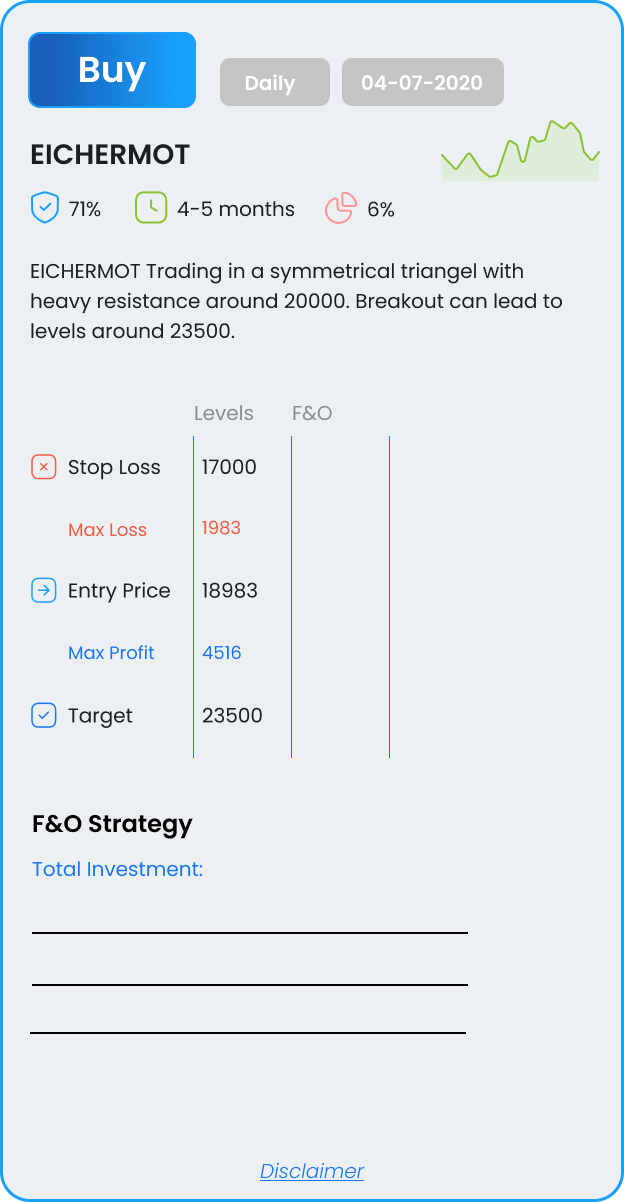

Trading in a symmetrical triangle with heavy resistance around 20000. Breakout can lead to levels around 23500.

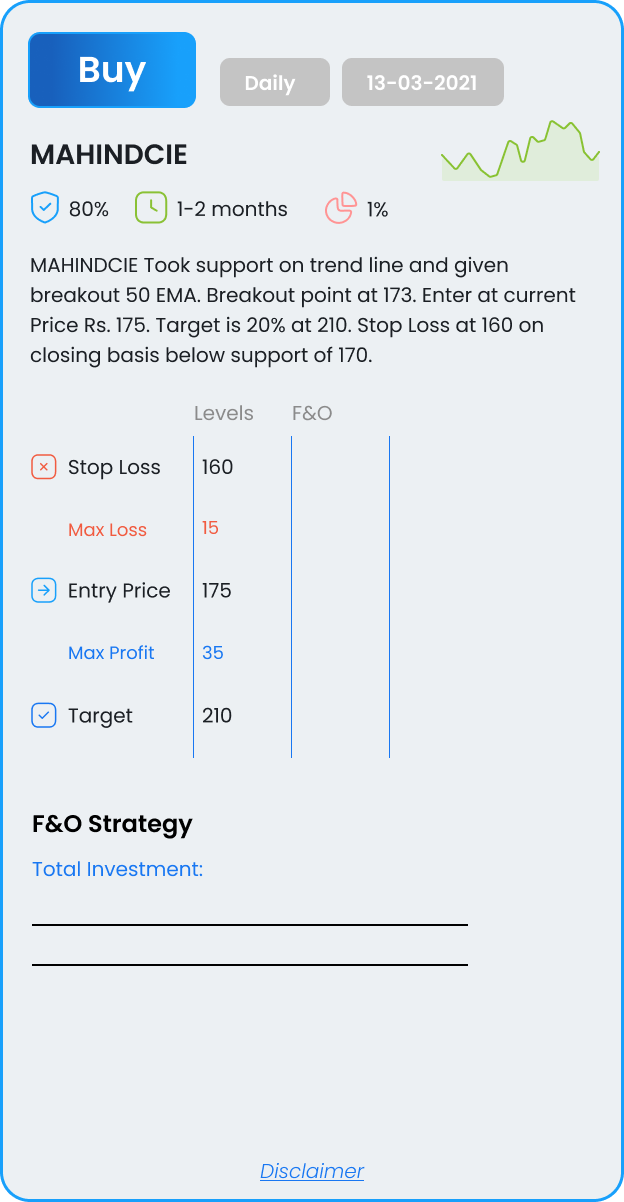

Took support on trend line and gave breakout 50 EMA. Breakout point at 173. Enter at the current Price of Rs. 175. Target is 20% at 210. Stop Loss at 160 on a closing basis below the support of 170.

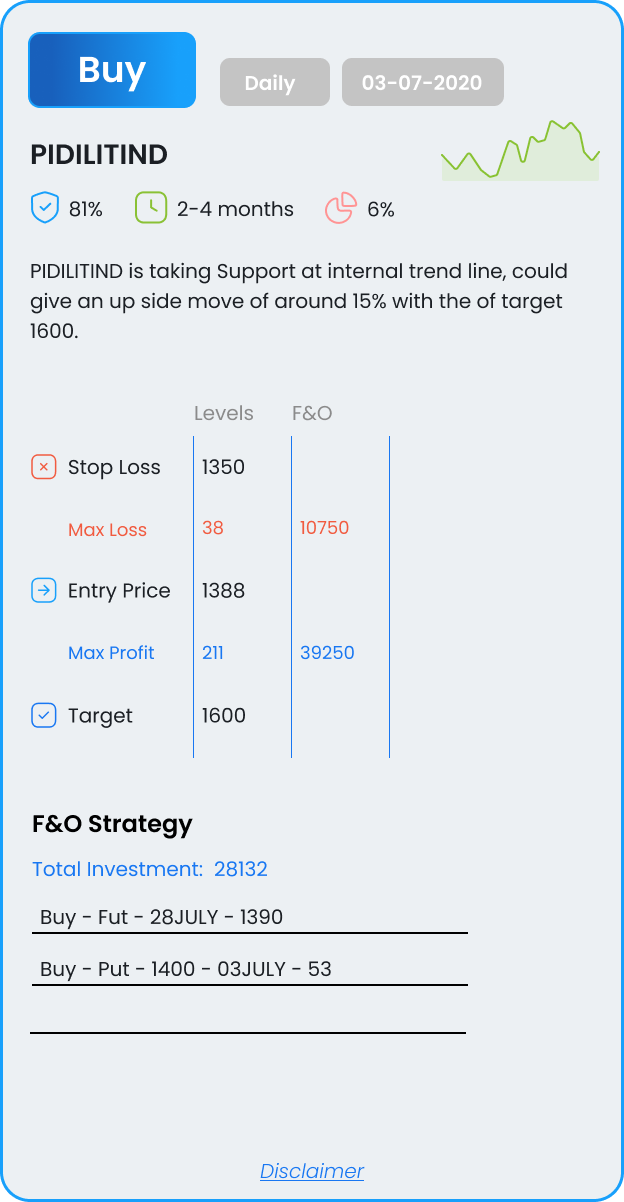

Taking Support at internal trend line, could give an up side move of around 15% with the of target 1600.