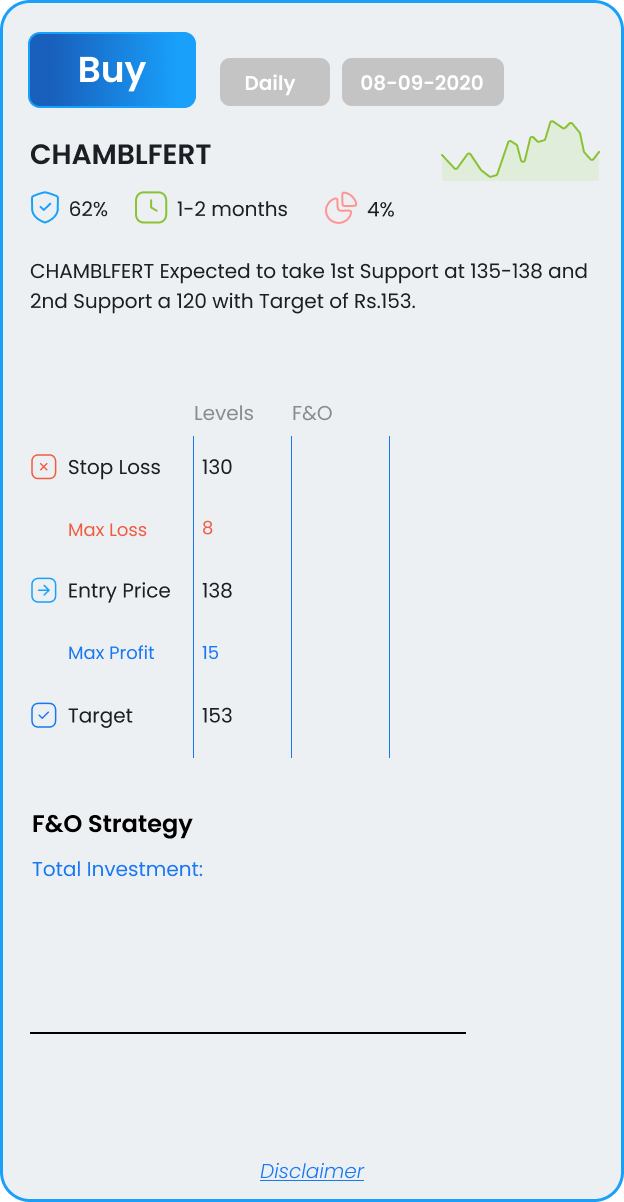

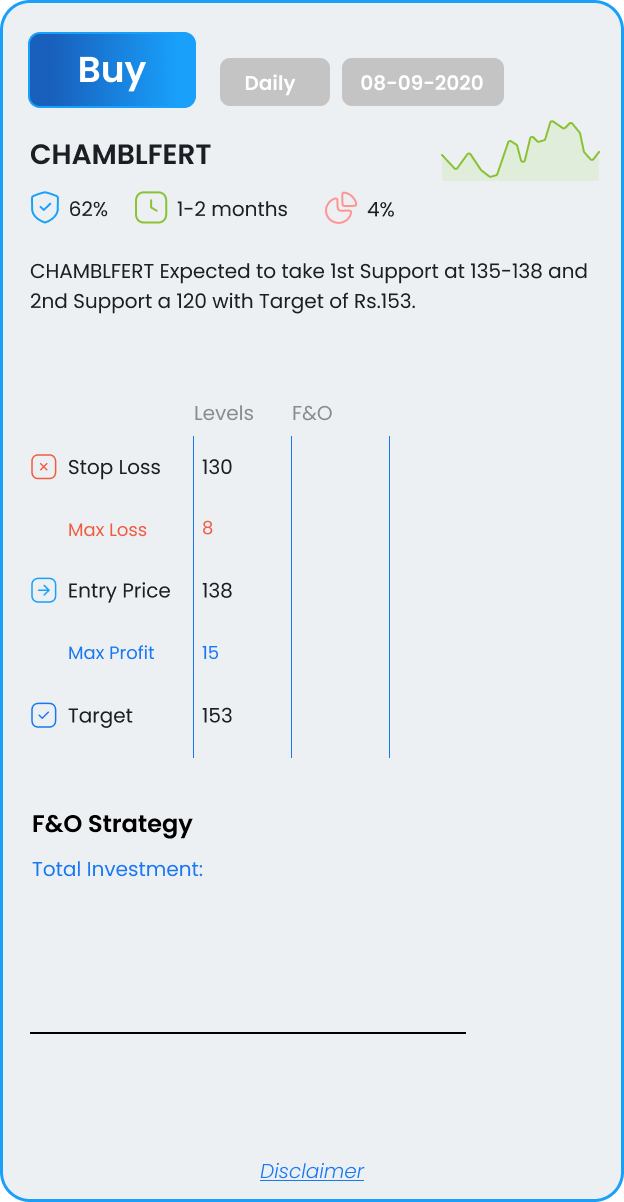

CHAMBLFERT

Expected to take 1st Support at 135-138 and 2nd Support a 120 with Target of Rs.153.

Expected to take 1st Support at 135-138 and 2nd Support a 120 with Target of Rs.153.

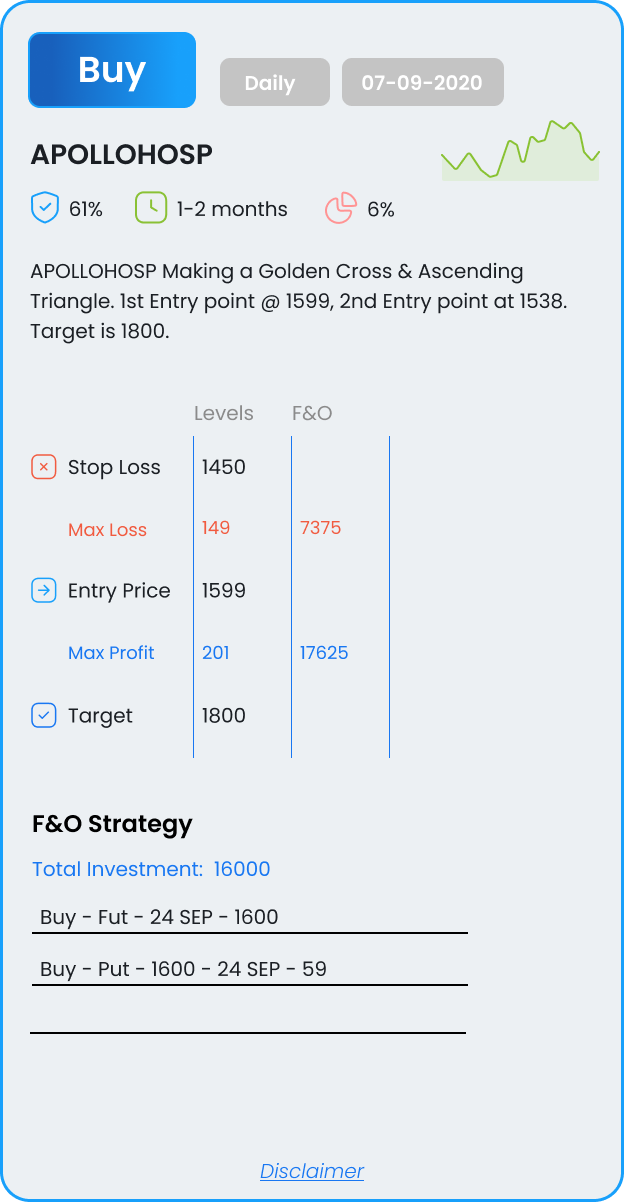

Making a Golden Cross & Ascending Triangle. 1st Entry point @ 1599, 2nd Entry point at 1538. Target is 1800.

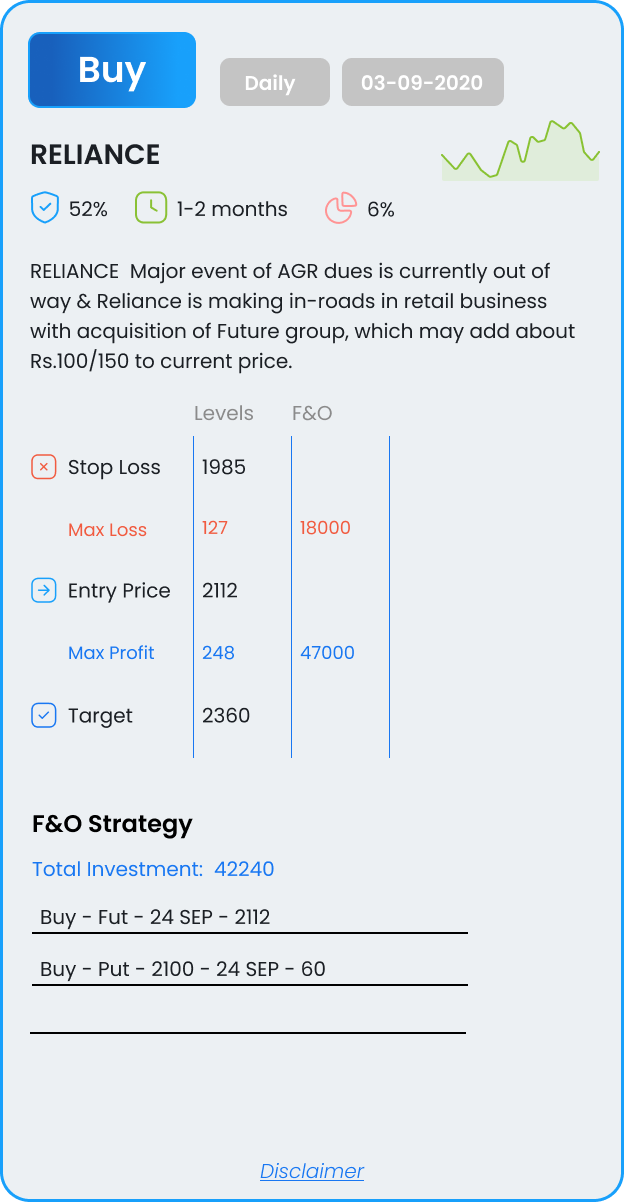

After a long consolidation zone, Bullish Flag pattern with a asymmetric triangle breakout could lead to fresh upside rally. Major event of AGR dues is currently out of way & Reliance is making in-roads in retail business with acquisition of Future group, which may add about Rs.100/150 to current price.

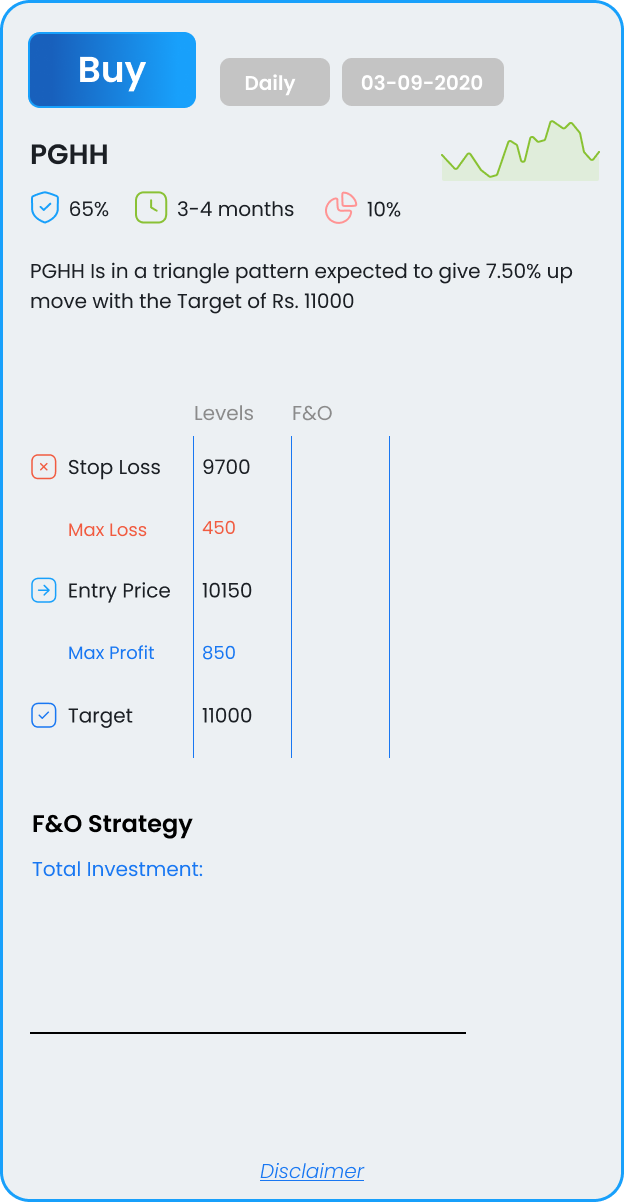

Is in a triangle pattern expected to give 7.50% up move with the Target of Rs. 11000

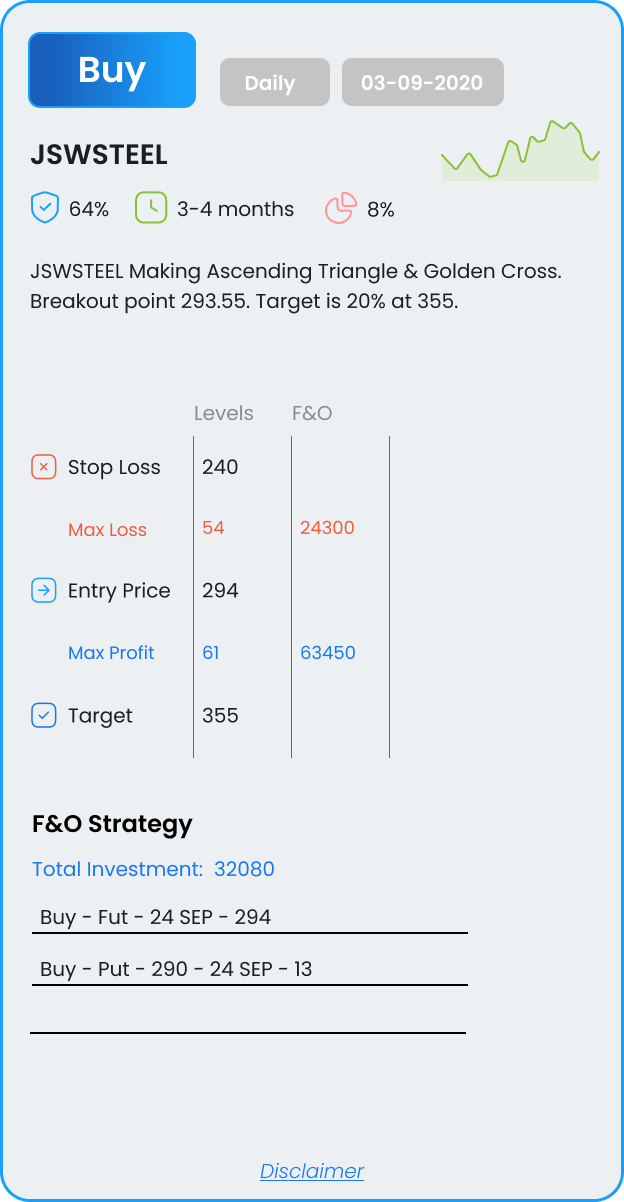

Making Ascending Triangle & Golden Cross. Breakout point 293.55. Target is 20% at 355.

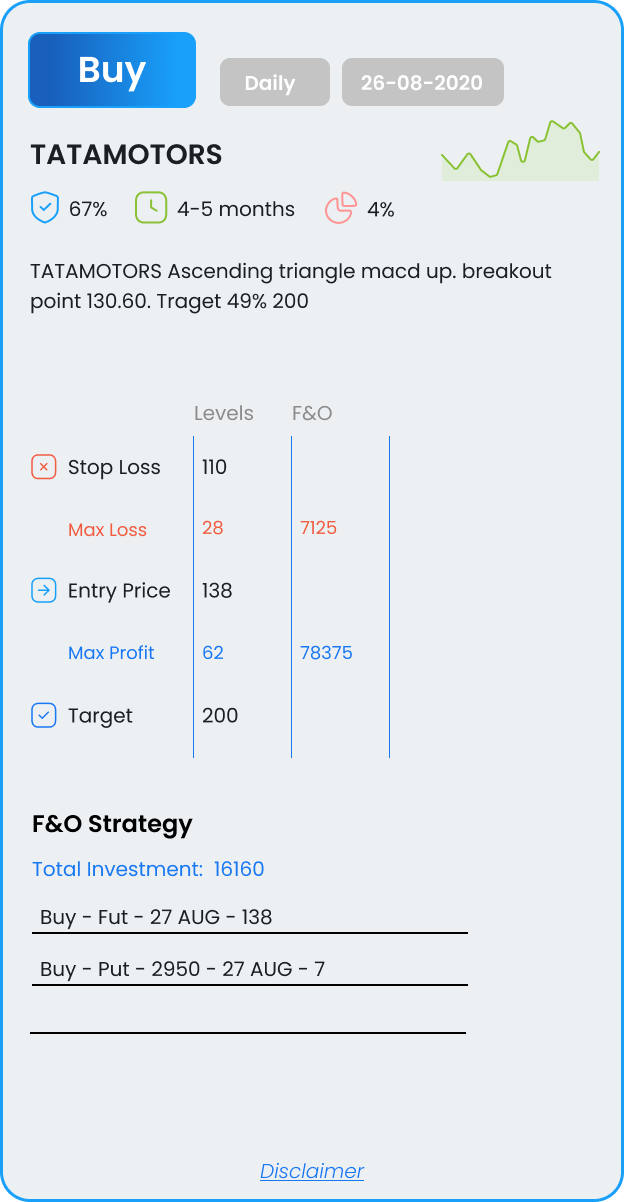

Ascending triangle macd up. breakout point 130.60. Target 49% 200

Hello reader, This is a quick read with 4 key websites that provide historical data. You can get upto 5000 hours of historical data using a technical analysis website tradingView However, if you have a paid subscription of the same website, you can get upto 10,000 hours of historical data. Apart from this you can […]

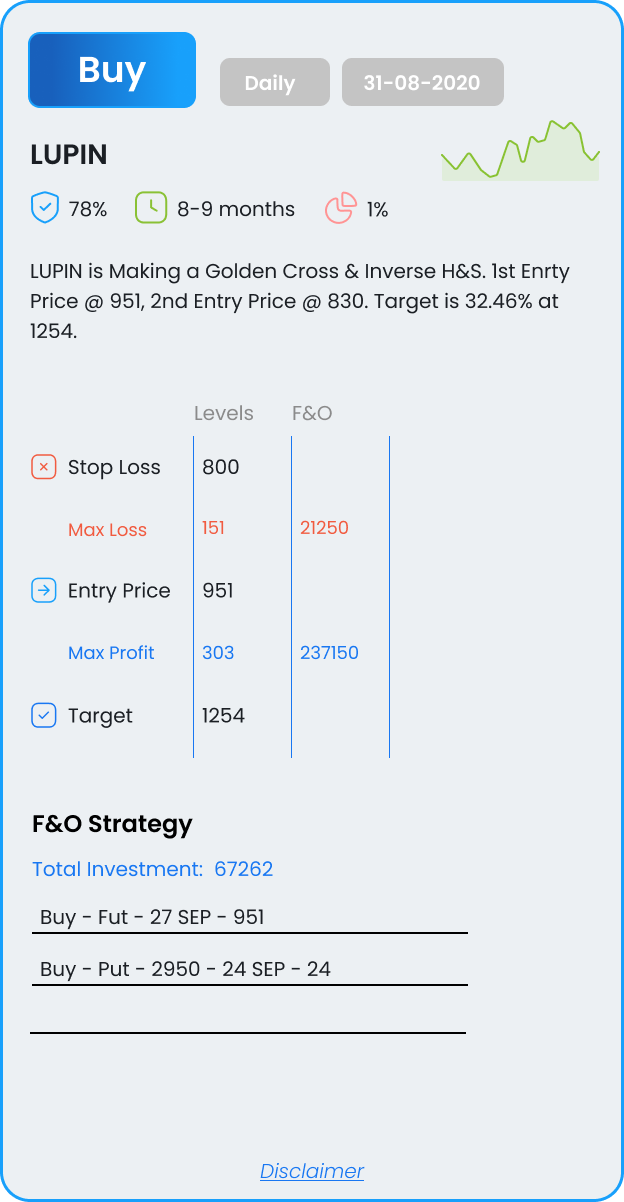

Making a Golden Cross & Inverse H&S. 1st Enrty Price @ 951, 2nd Entry Price @ 830. Target is 32.46% at 1254.

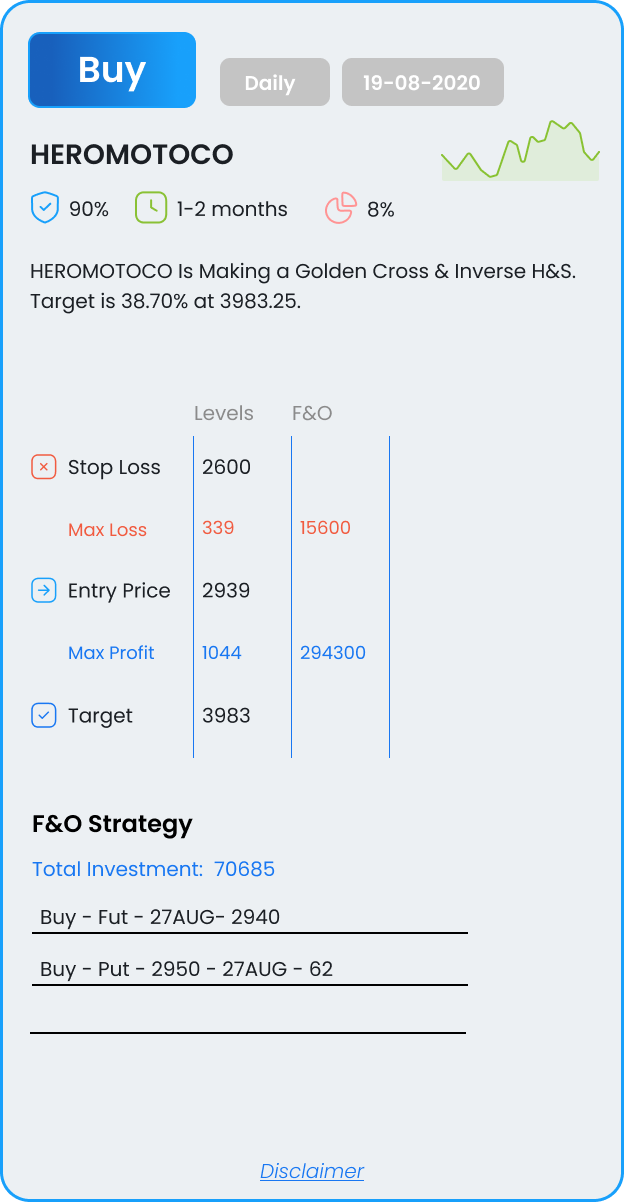

Making a Golden Cross & Inverse H&S. Target is 38.70% at 3983.25.

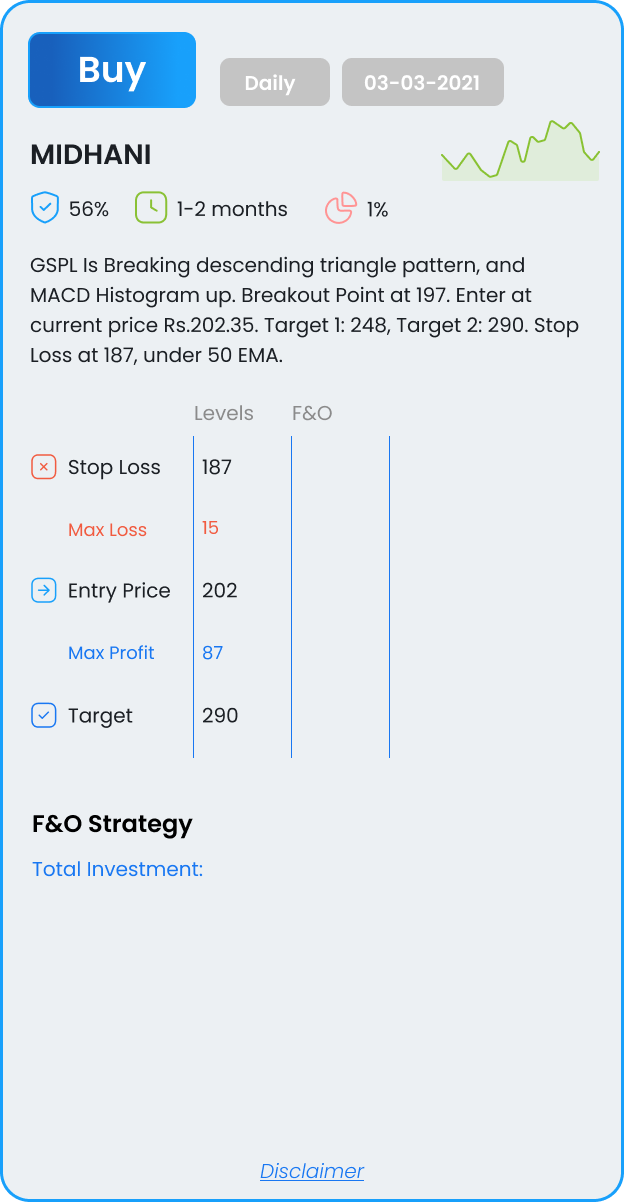

Is Breaking descending triangle pattern, and MACD Histogram up. Breakout Point at 197. Enter at the current price of Rs.202.35. Target 1: 248, Target 2: 290. Stop Loss at 187, under 50 EMA.