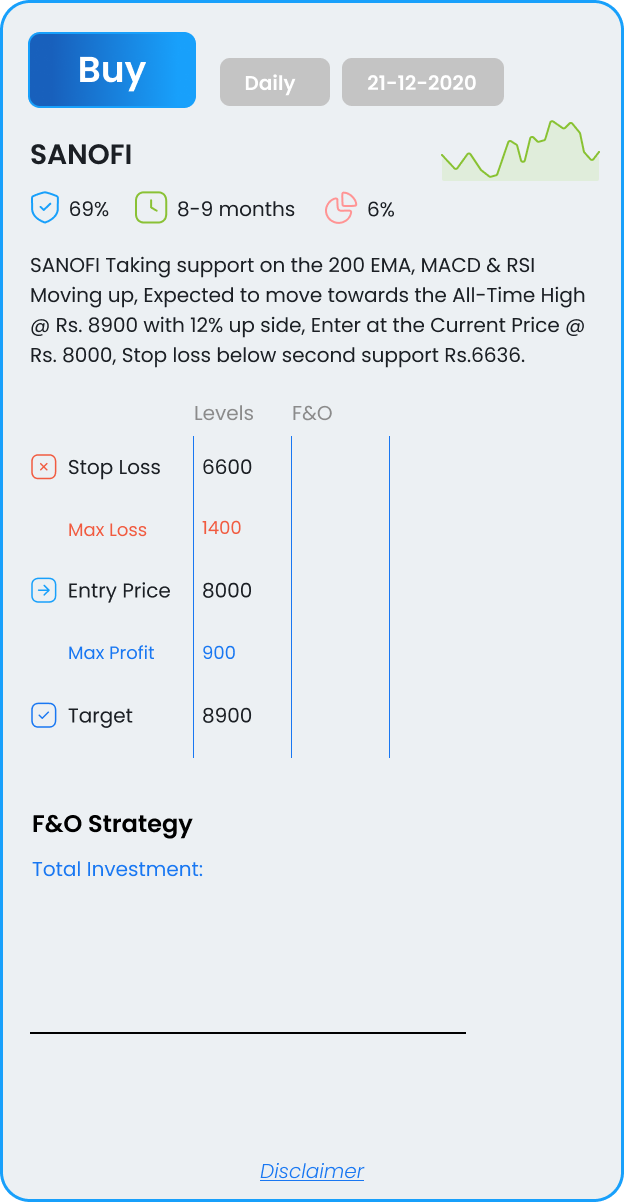

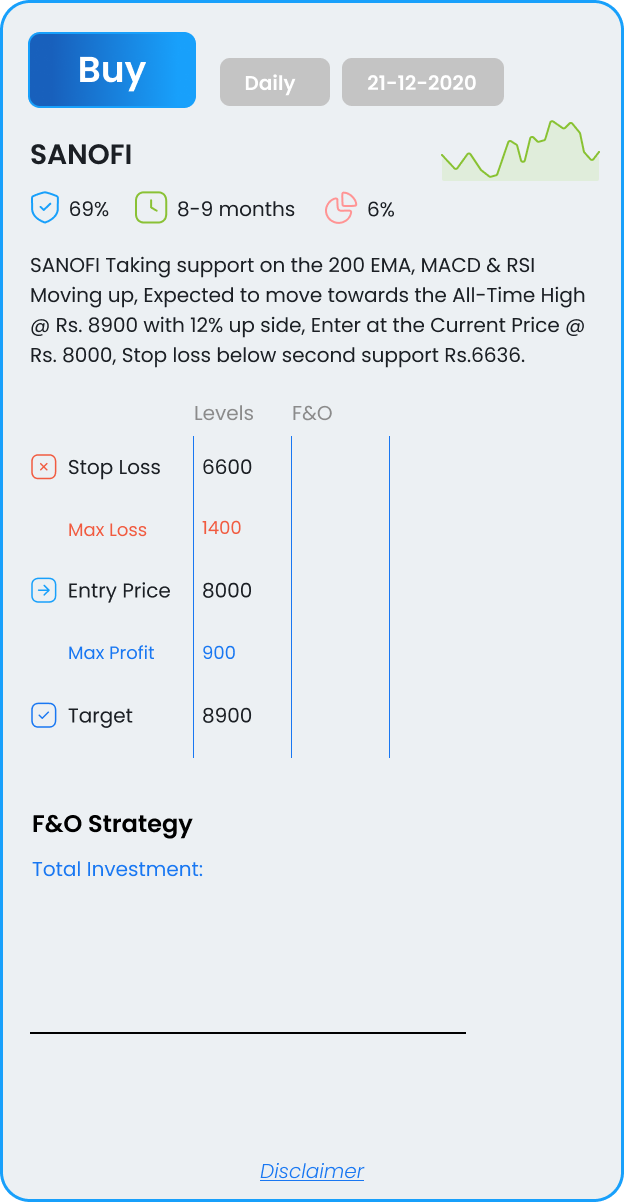

SANOFI

Taking support on the 200 EMA, MACD & RSI Moving up, Expected to move towards the All-Time High @ Rs. 8900 with 12% up side, Enter at the Current Price @ Rs. 8000, Stop loss below second support Rs.6636.

Taking support on the 200 EMA, MACD & RSI Moving up, Expected to move towards the All-Time High @ Rs. 8900 with 12% up side, Enter at the Current Price @ Rs. 8000, Stop loss below second support Rs.6636.

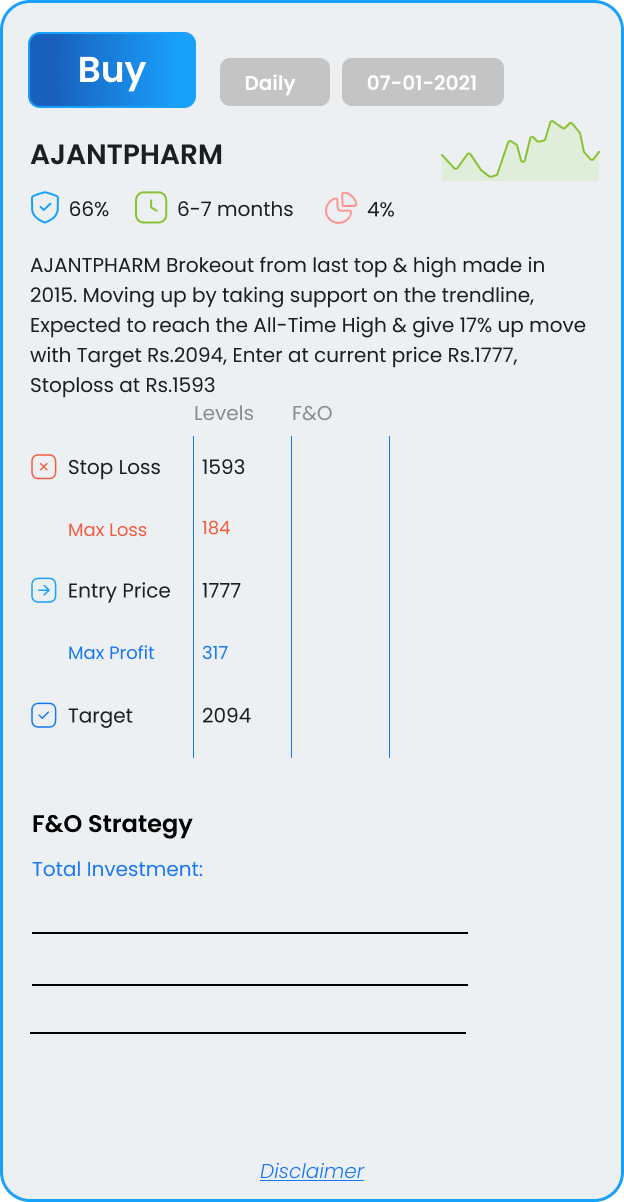

Brokeout from last top & high made in 2015. Moving up by taking support on the trendline, Expected to reach the All-Time High & give 17% up move with Target Rs.2094, Enter at current price Rs.1777, Stoploss at Rs.1593

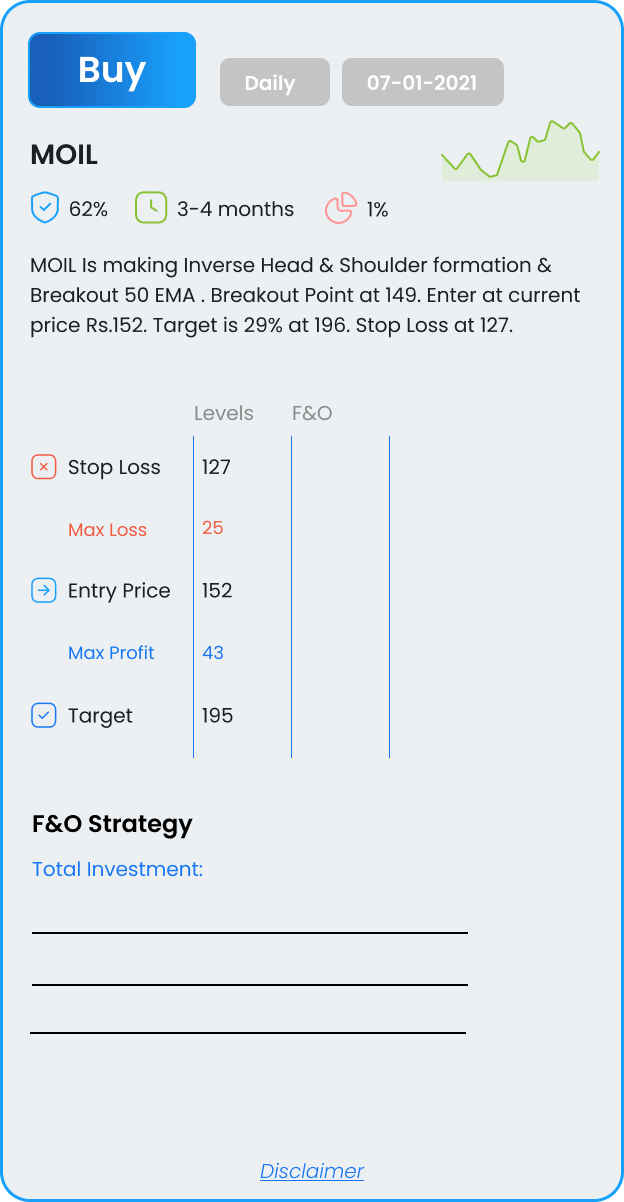

Is making Inverse Head & Shoulder formation & Breakout 50 EMA . Breakout Point at 149. Enter at current price Rs.152. Target is 29% at 196. Stop Loss at 127.

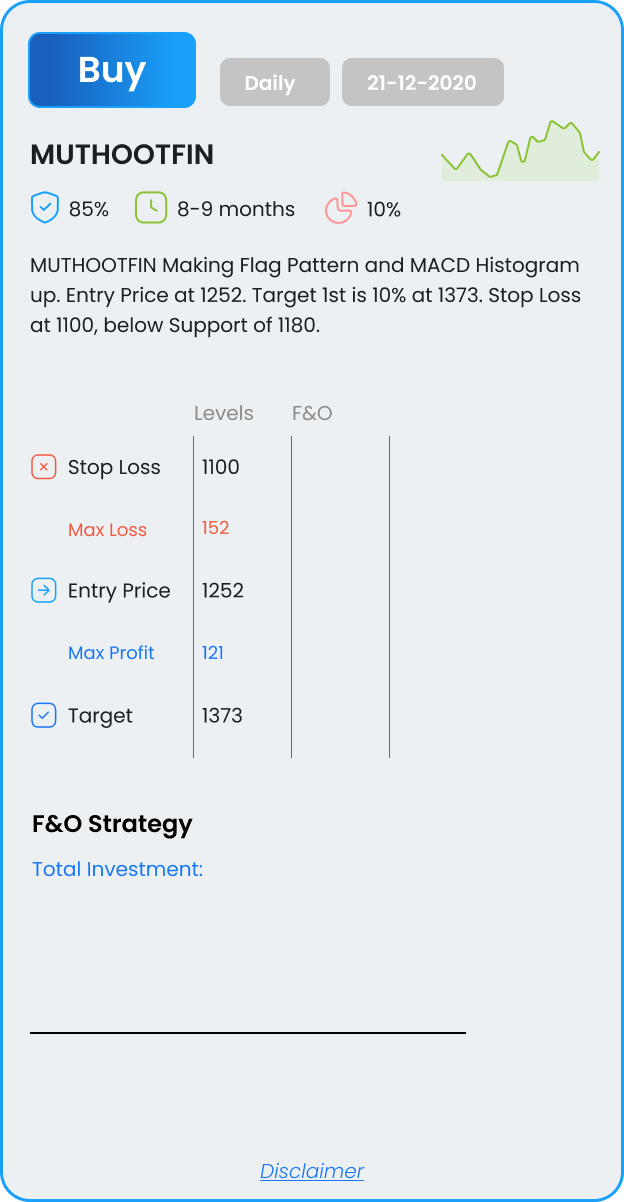

Making Flag Pattern and MACD Histogram up. Entry Price at 1252. Target 1st is 10% at 1373. Stop Loss at 1100, below Support of 1180.

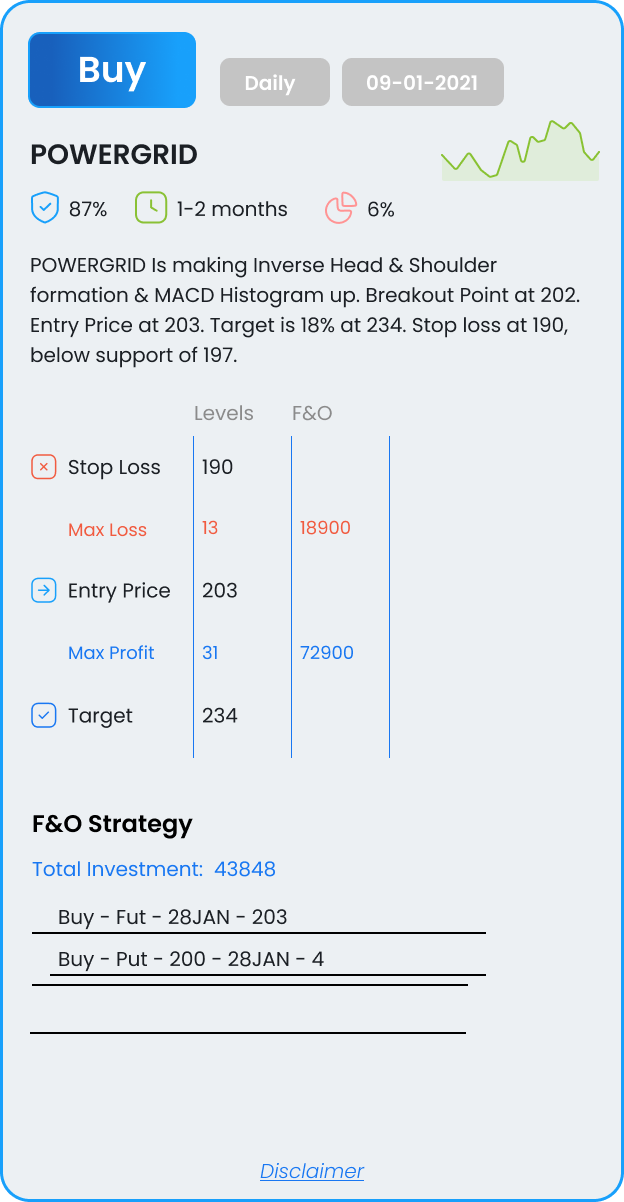

Is making Inverse Head & Shoulder formation & MACD Histogram up. Breakout Point at 202. Entry Price at 203. Target is 18% at 234. Stop loss at 190, below support of 197.

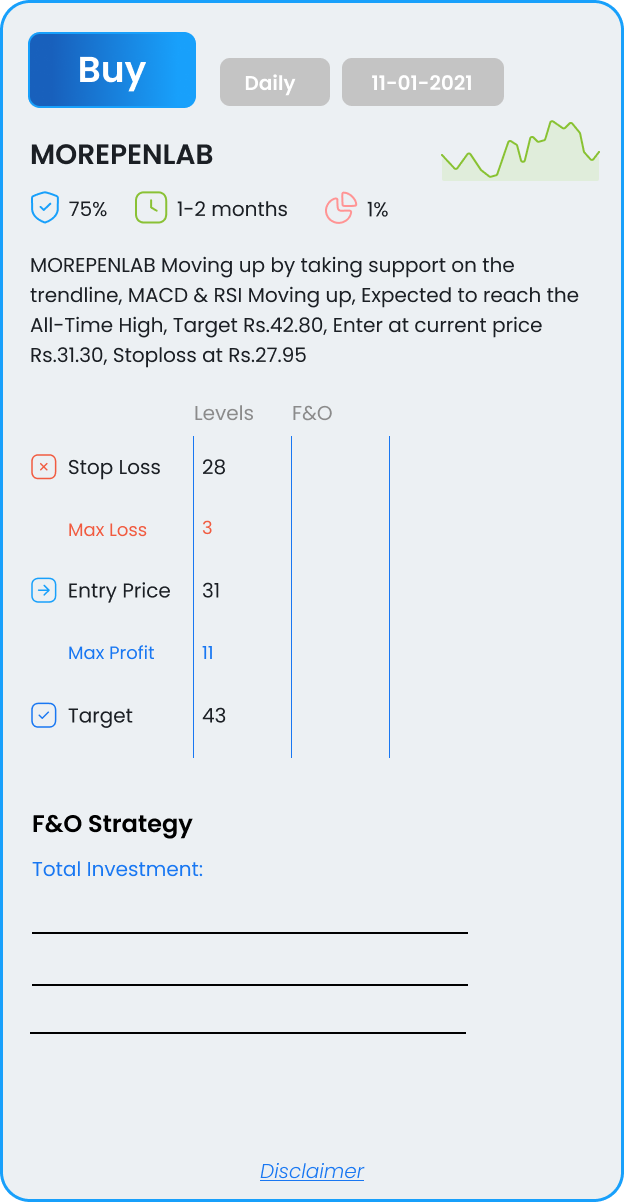

Moving up by taking support on the trendline, MACD & RSI Moving up, Expected to reach the All-Time High, Target Rs.42.80, Enter at current price Rs.31.30, Stoploss at Rs.27.95

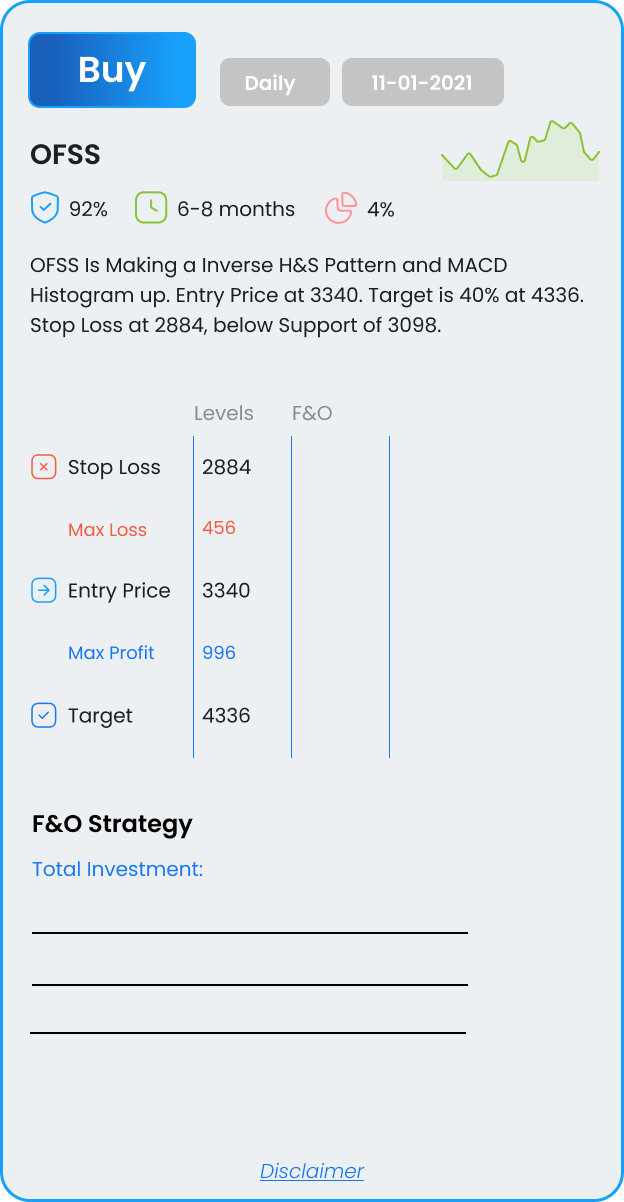

Is Making an Inverse H&S Pattern and MACD Histogram up. Entry Price at 3340. Target is 40% at 4336. Stop Loss at 2884, below Support of 3098.

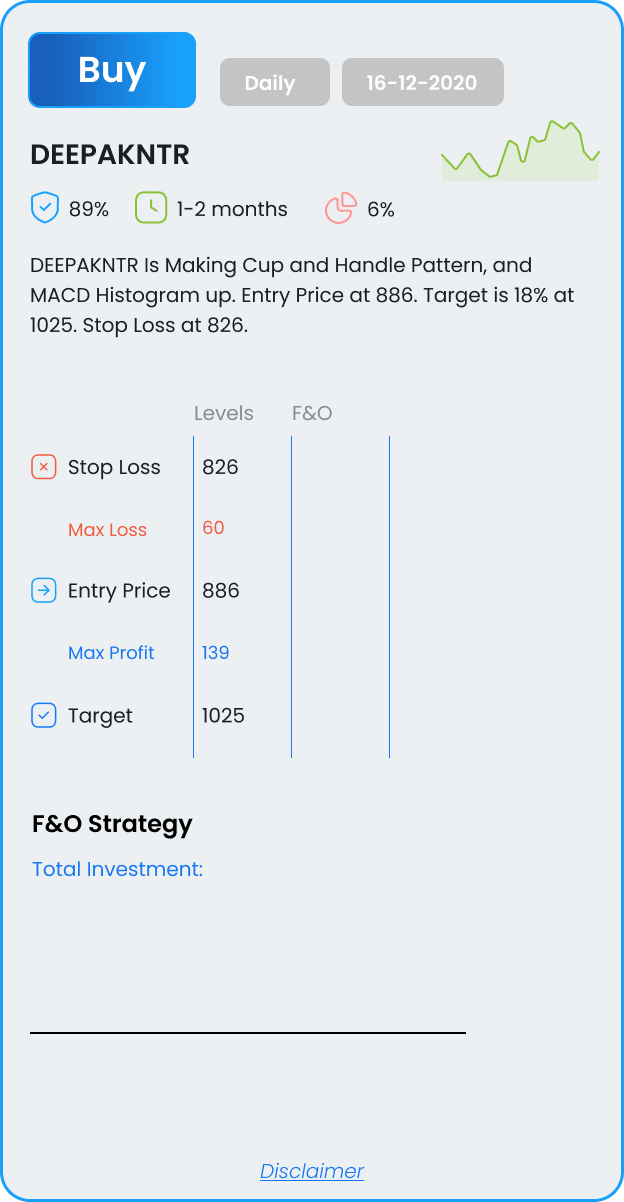

Is Making Cup and Handle Pattern, and MACD Histogram up. Entry Price at 886. Target is 18% at 1025. Stop Loss at 826.

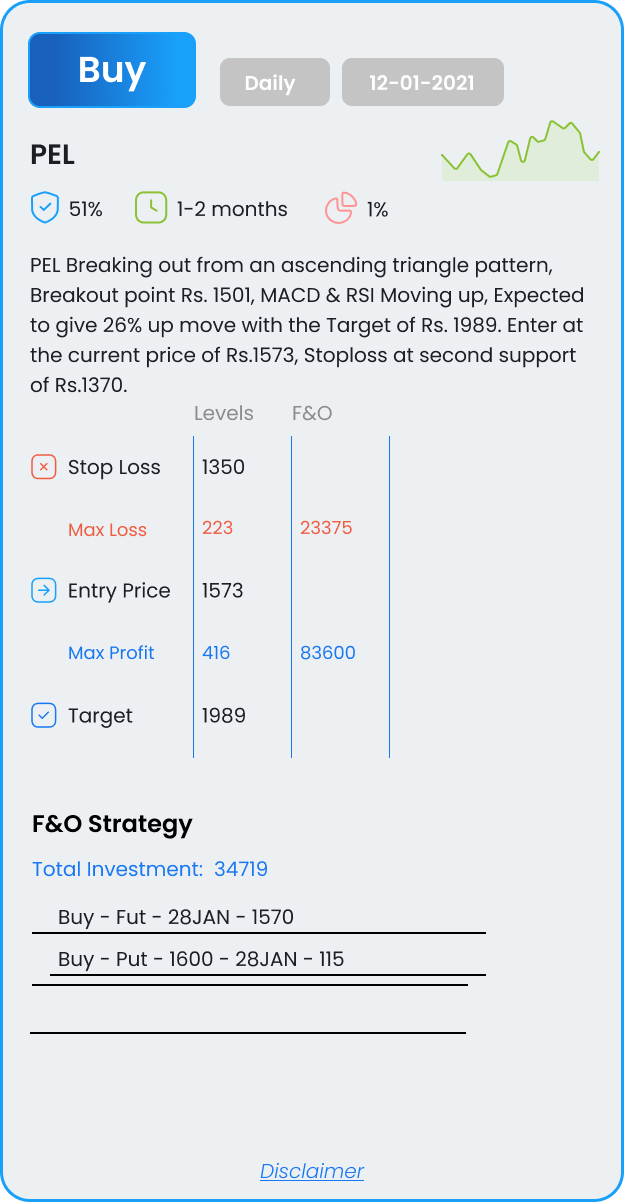

Breaking out from an ascending triangle pattern, Breakout point Rs. 1501, MACD & RSI Moving up, Expected to give 26% up move with the Target of Rs. 1989. Enter at the current price of Rs.1573, Stoploss at second support of Rs.1370.

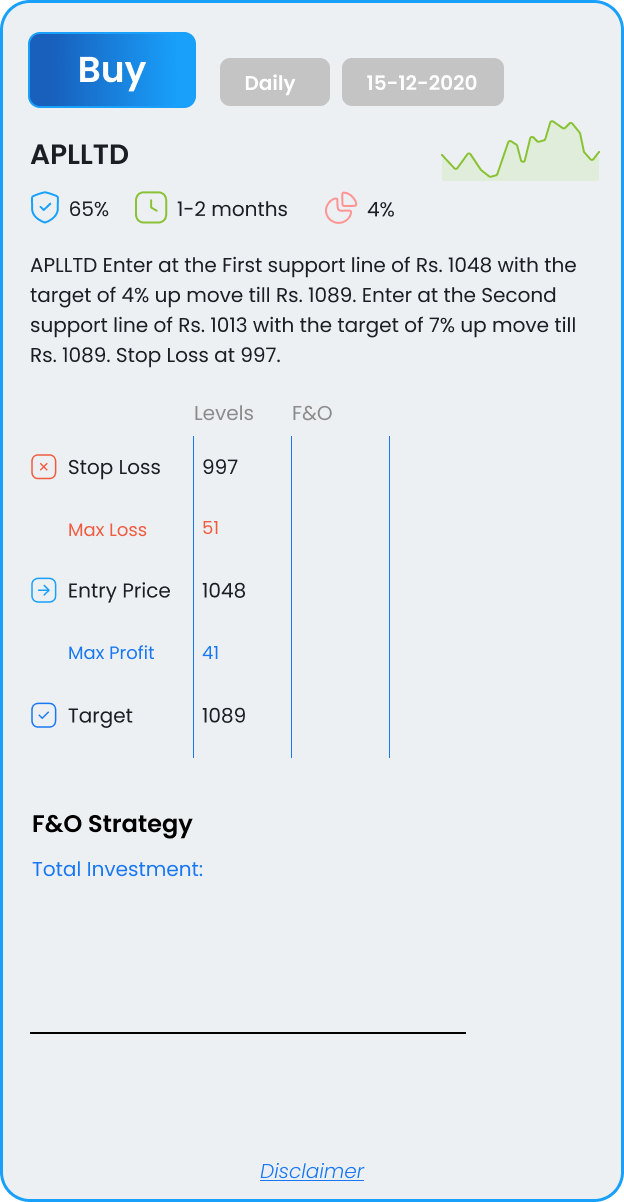

Enter at the First support line of Rs. 1048 with the target of 4% up move till Rs. 1089. Enter at the Second support line of Rs. 1013 with the target of 7% up move till Rs. 1089. Stop Loss at 997.