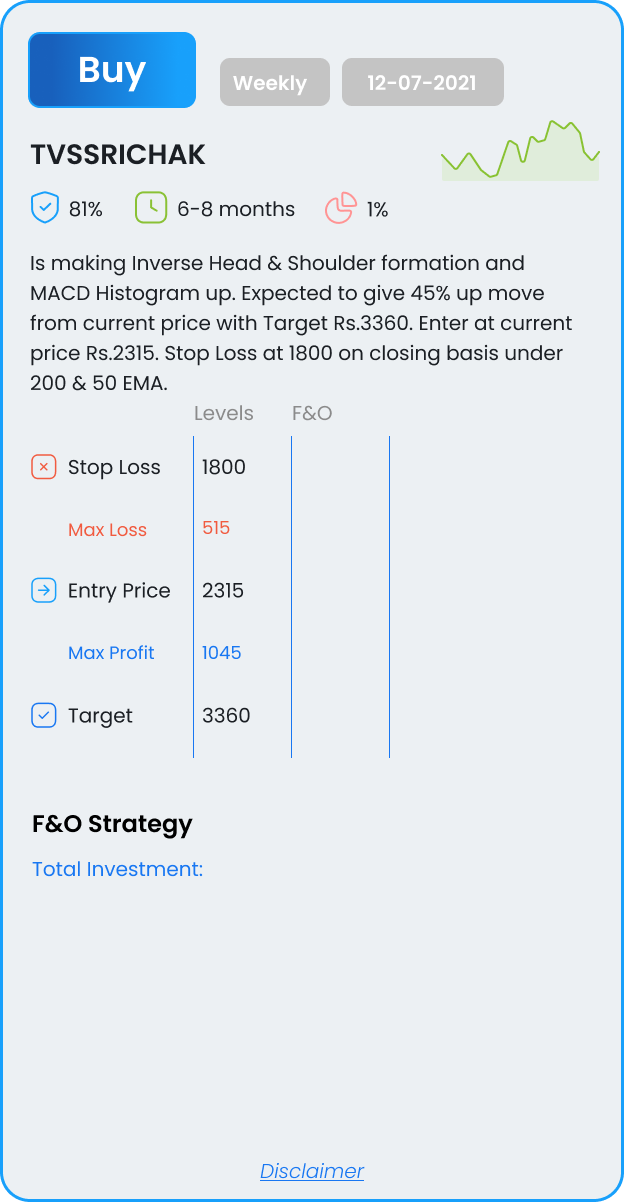

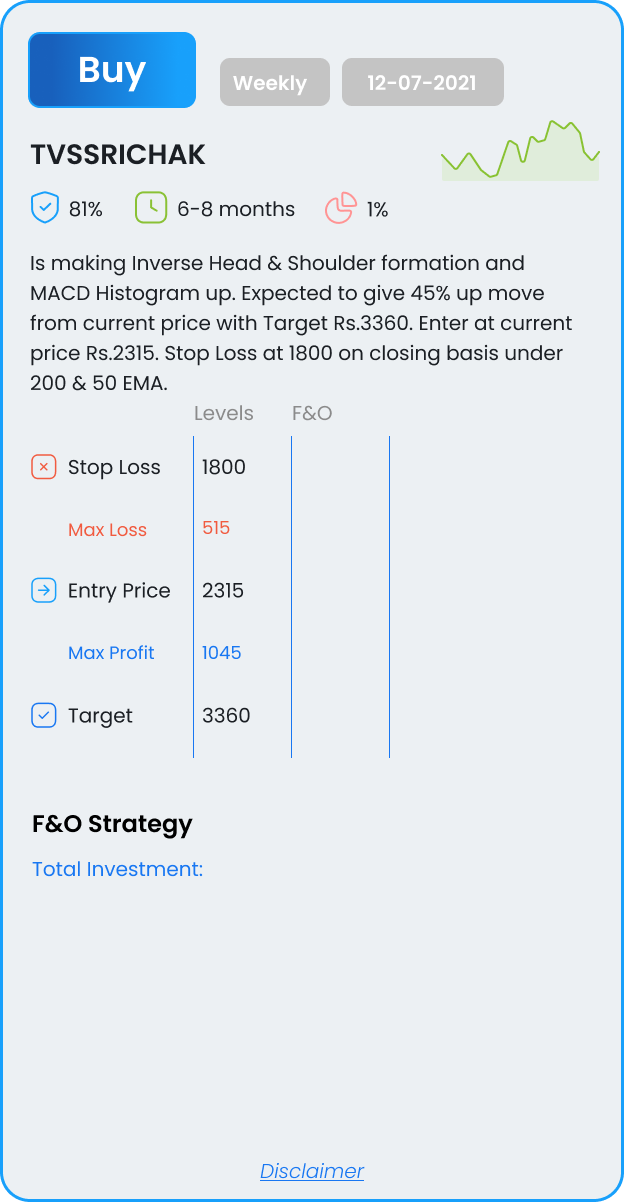

TVSSRICHAK

Is making Inverse Head & Shoulder formation and MACD Histogram up. Expected to give 45% up move from current price with Target Rs.3360. Enter at current price Rs.2315. Stop Loss at 1800 on closing basis under 200 & 50 EMA.

Is making Inverse Head & Shoulder formation and MACD Histogram up. Expected to give 45% up move from current price with Target Rs.3360. Enter at current price Rs.2315. Stop Loss at 1800 on closing basis under 200 & 50 EMA.

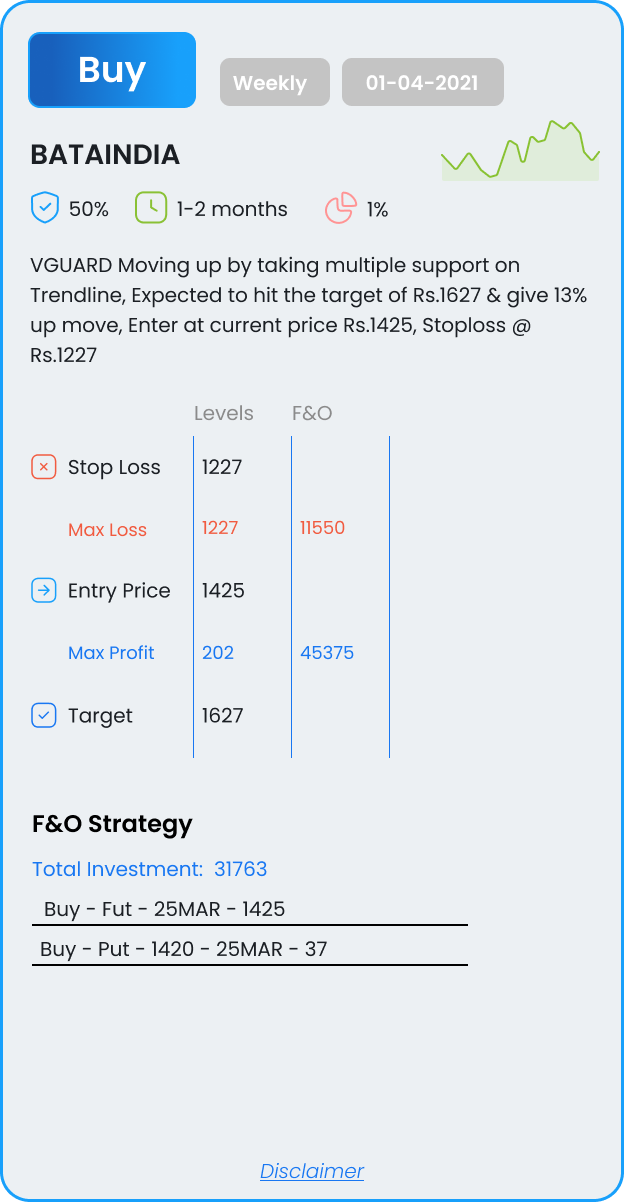

Moving up by taking multiple support on Trendline, Expected to hit the target of Rs.1627 & give 13% up move, Enter at current price Rs.1425, Stoploss @ Rs.1227

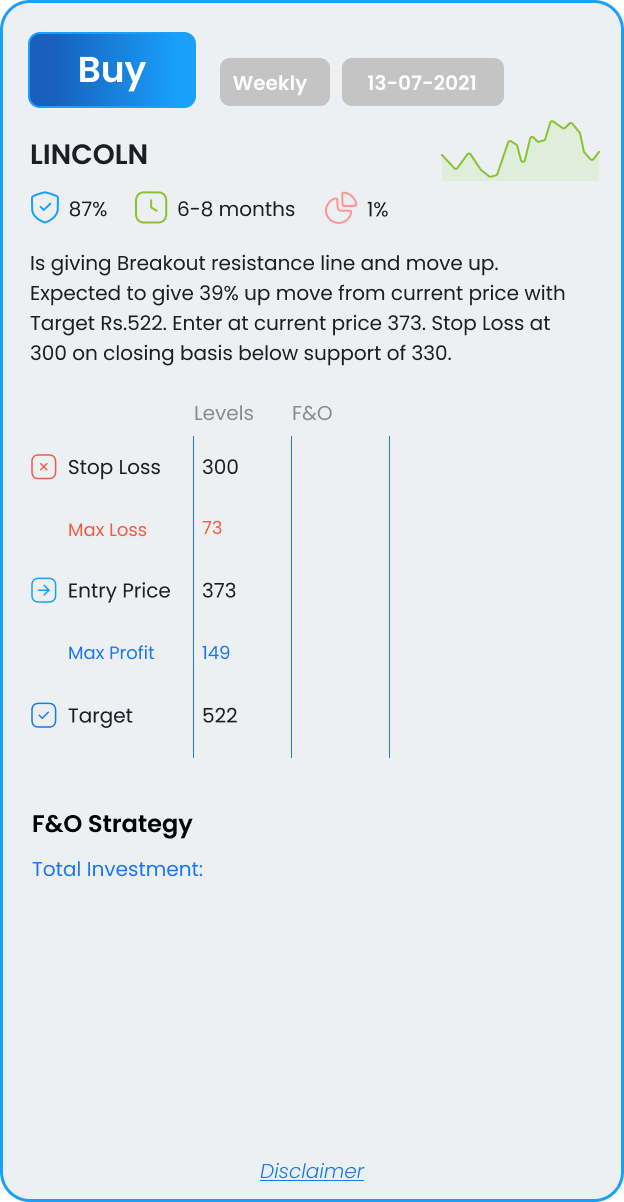

Is giving Breakout resistance line and move up. Expected to give 39% up move from current price with Target Rs.522. Enter at current price 373. Stop Loss at 300 on closing basis below support of 330.

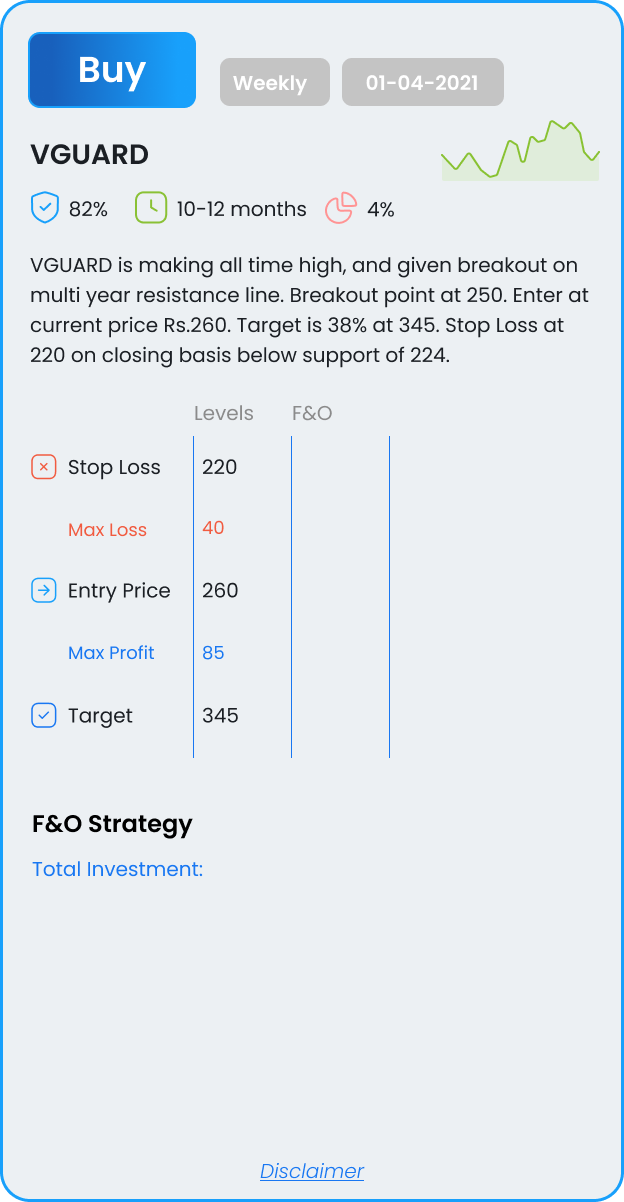

is making all time high, and given breakout on multi year resistance line. Breakout point at 250. Enter at current price Rs.260. Target is 38% at 345. Stop Loss at 220 on closing basis below support of 224.

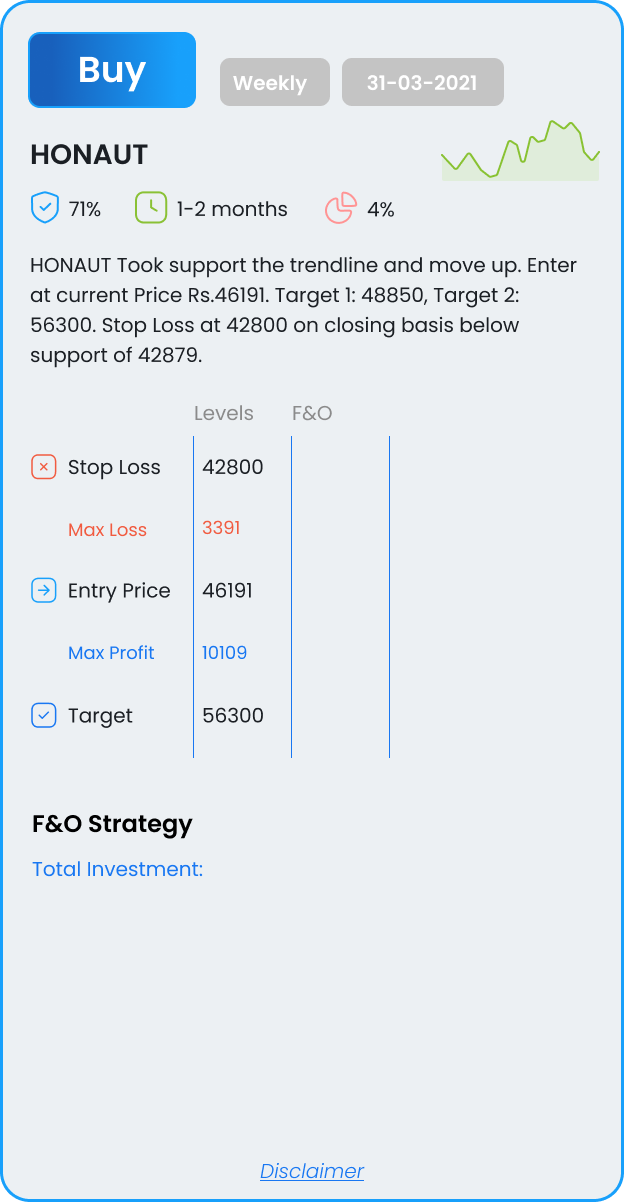

Took support the trendline and move up. Enter at current Price Rs.46191. Target 1: 48850, Target 2: 56300. Stop Loss at 42800 on closing basis below support of 42879.

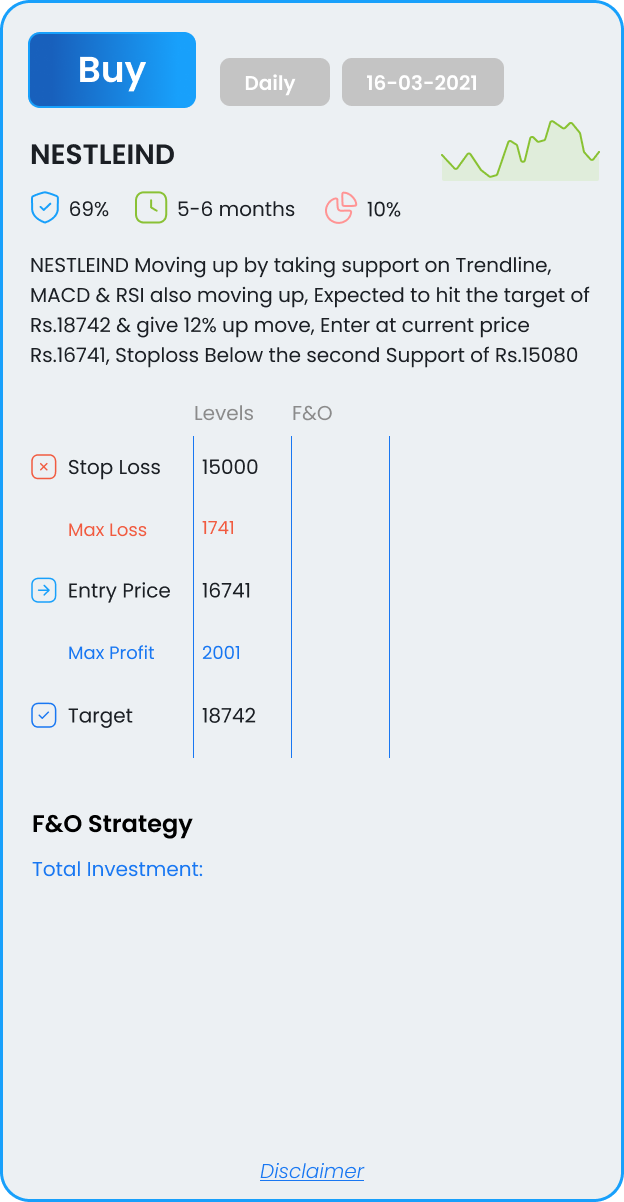

Moving up by taking support on Trendline, MACD & RSI also moving up, Expected to hit the target of Rs.18742 & give 12% up move, Enter at current price Rs.16741, Stoploss Below the second Support of Rs.15080

Is making Inverse Head & Shoulder formation. Enter at current Price Rs.517. Target is 43% at 643. Stop loss at 420 below support 2 429

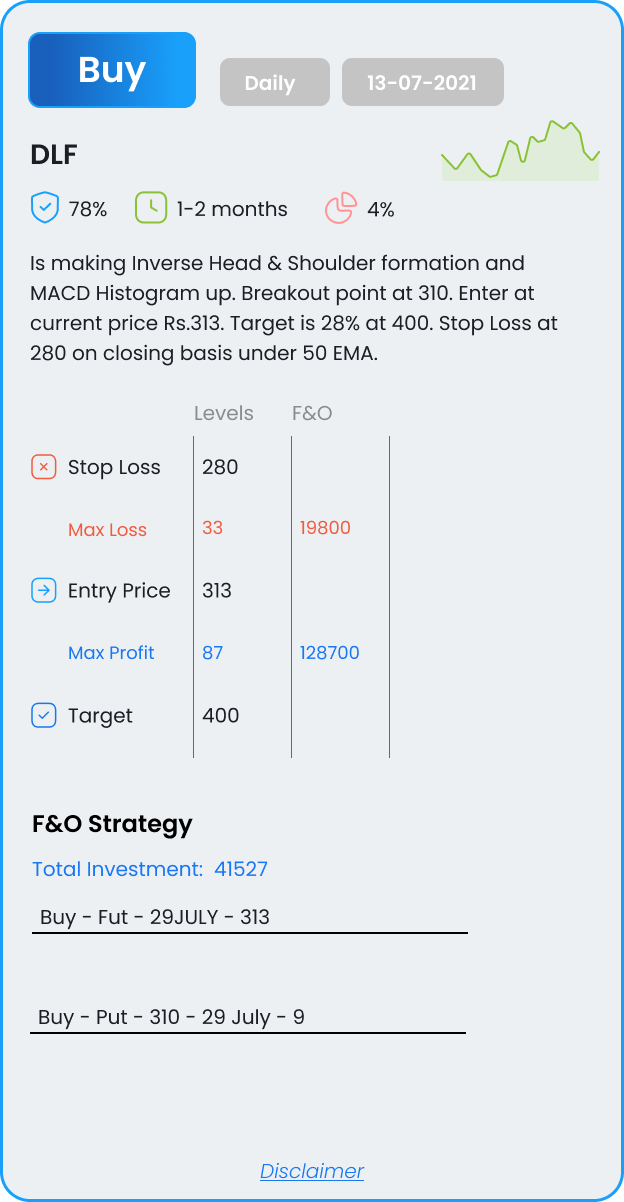

Is making Inverse Head & Shoulder formation and MACD Histogram up. Breakout point at 310. Enter at current price Rs.313. Target is 28% at 400. Stop Loss at 280 on closing basis under 50 EMA.

Is near all time high. Took Support on resistance line and move up. Enter at current price Rs.1989. Target is 30% at 2570. Stop Loss at 1550 on closing basis below support of 1565.

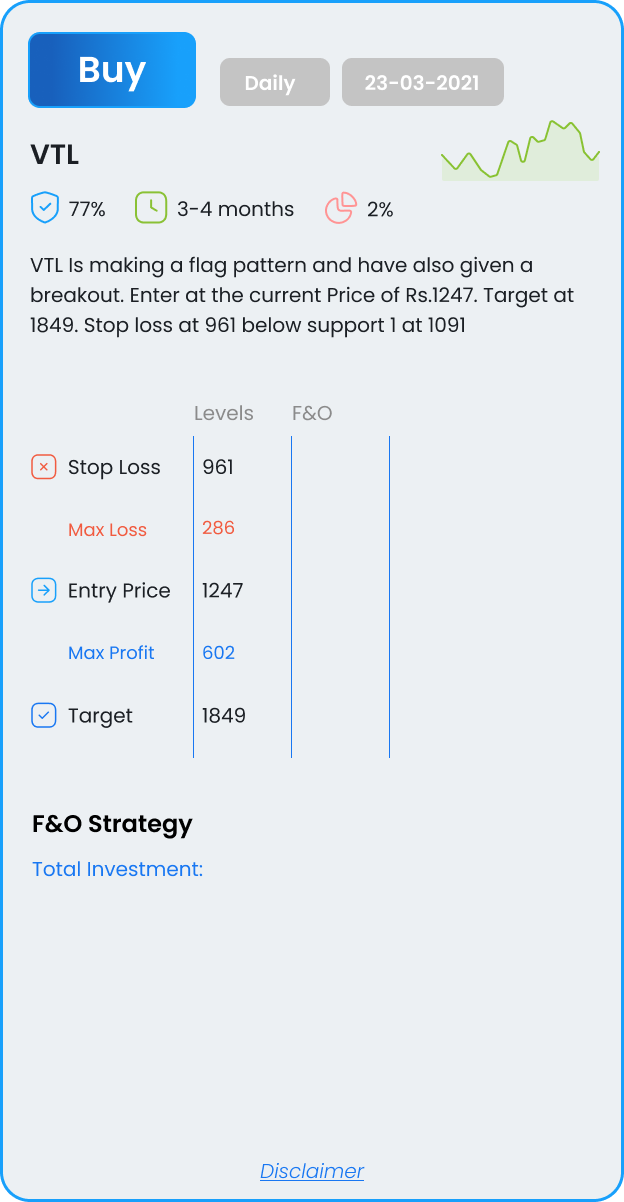

Is making a flag pattern and have also given a breakout. Enter at the current Price of Rs.1247. Target at 1849. Stop loss at 961 below support 1 at 1091