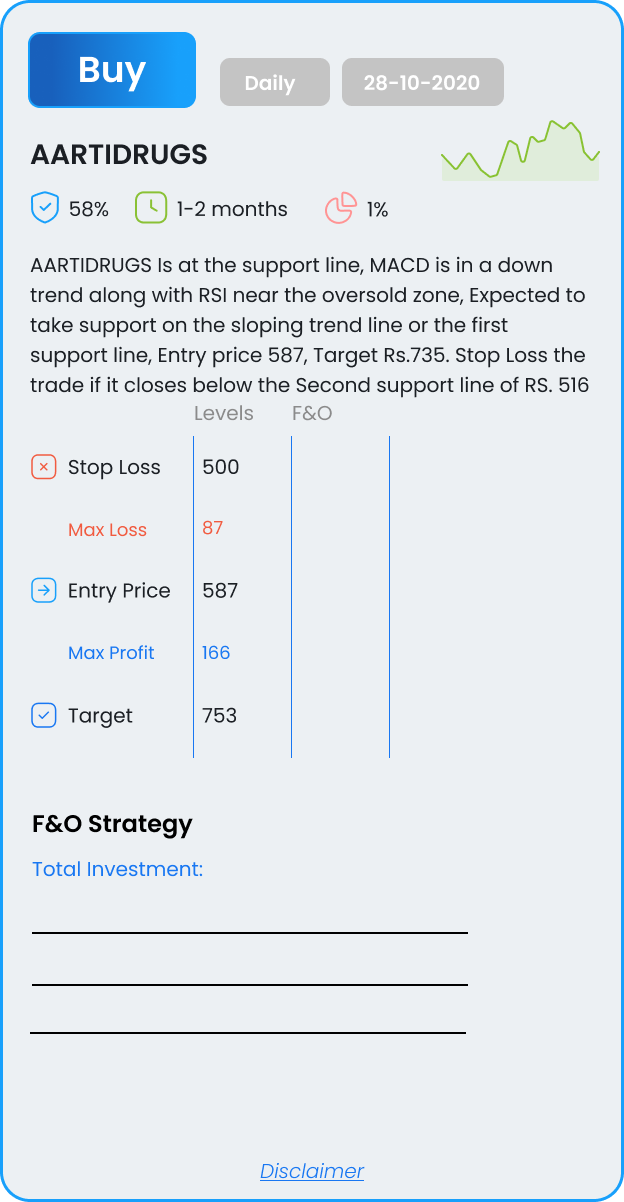

AARTIDRUGS

Is at the support line, MACD is in a down trend along with RSI near the oversold zone, Expected to take support on the sloping trend line or the first support line, Entry price 587, Target Rs.735. Stop Loss the trade if it closes below the Second support line of RS. 516