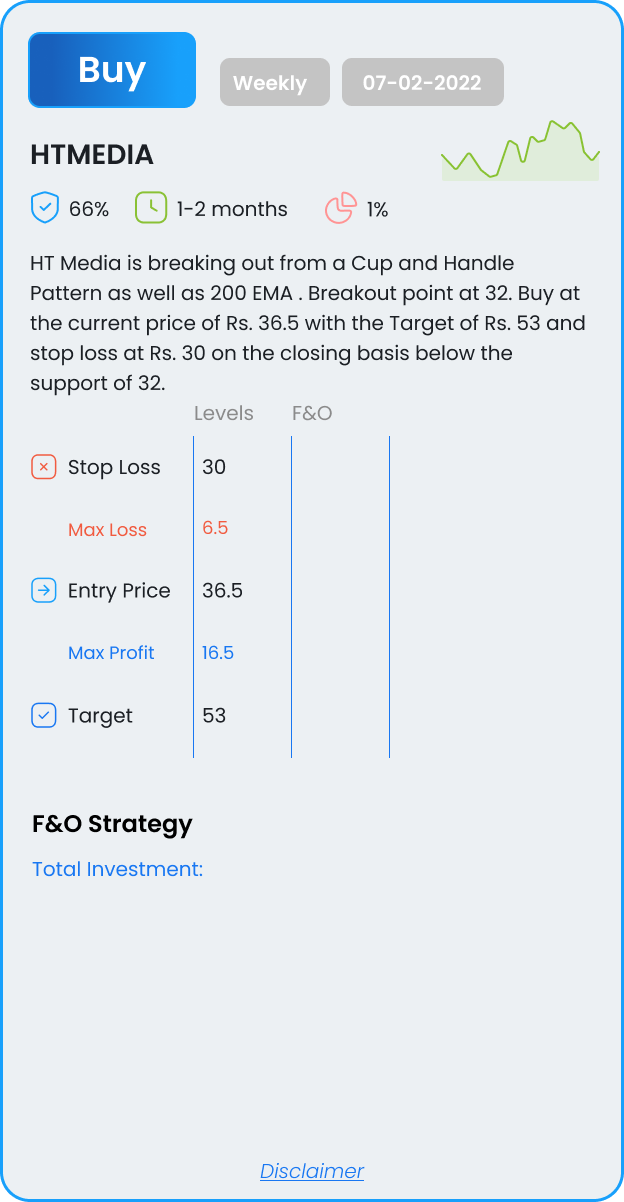

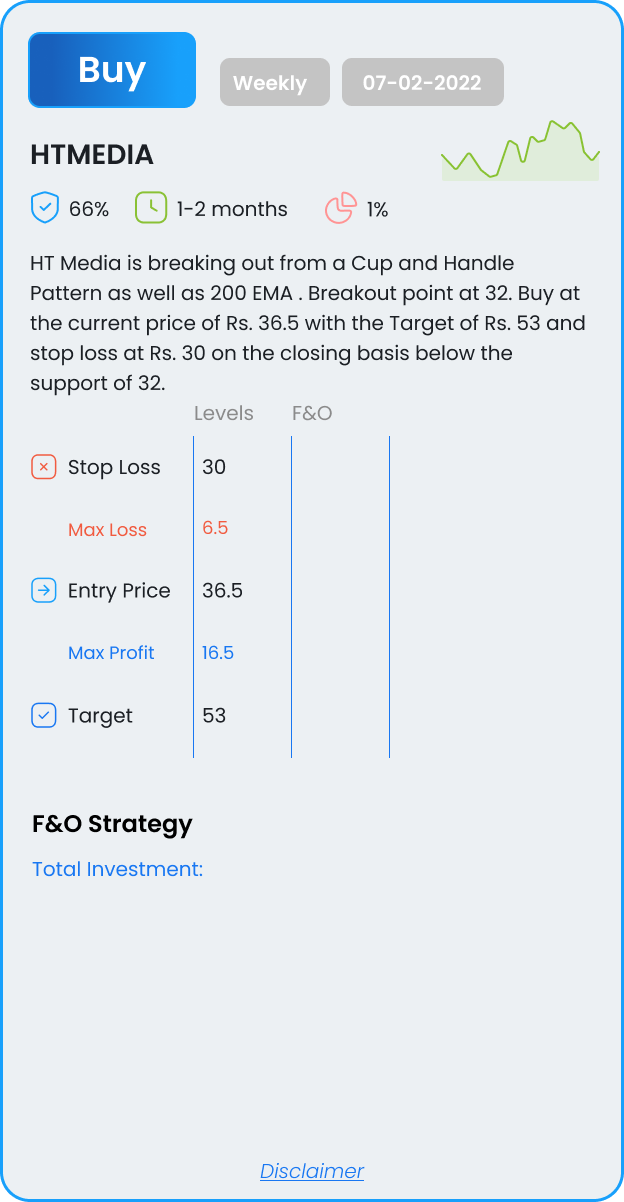

HTMEDIA

HT Media is breaking out from a Cup and Handle Pattern as well as 200 EMA . Breakout point at 32. Buy at the current price of Rs. 36.5 with the Target of Rs. 53 and stop loss at Rs. 30 on the closing basis below the support of 32.

HT Media is breaking out from a Cup and Handle Pattern as well as 200 EMA . Breakout point at 32. Buy at the current price of Rs. 36.5 with the Target of Rs. 53 and stop loss at Rs. 30 on the closing basis below the support of 32.

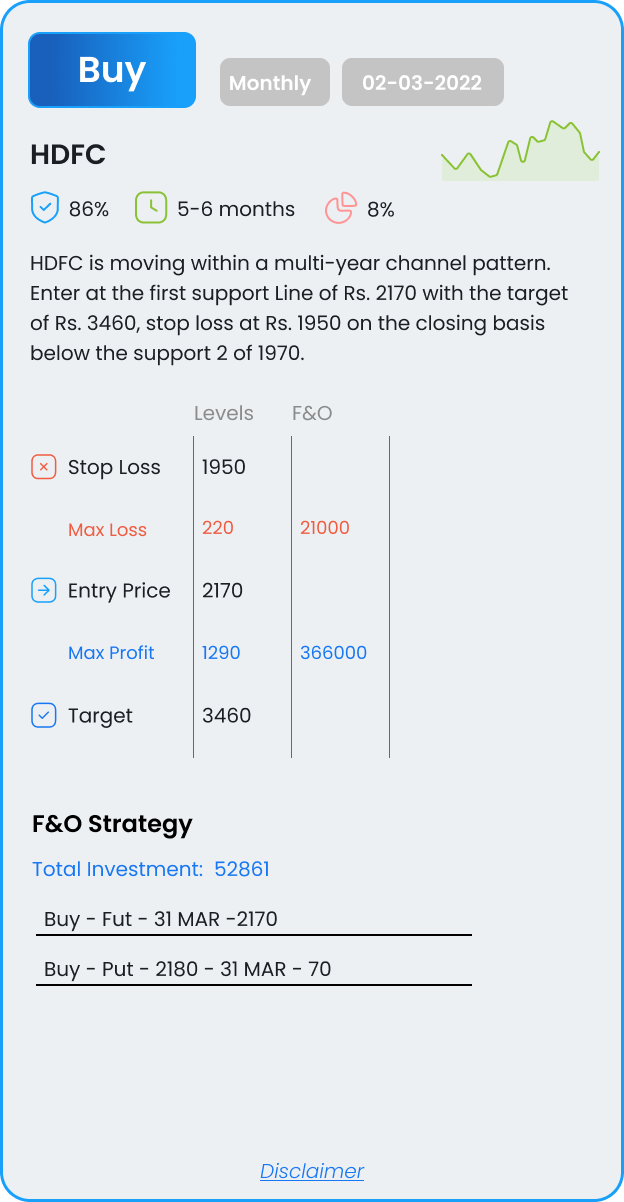

HDFC is moving within a multi-year channel pattern. Enter at the first support Line of Rs. 2170 with the target of Rs. 3460, stop loss at Rs. 1950 on the closing basis below the support 2 of 1970.

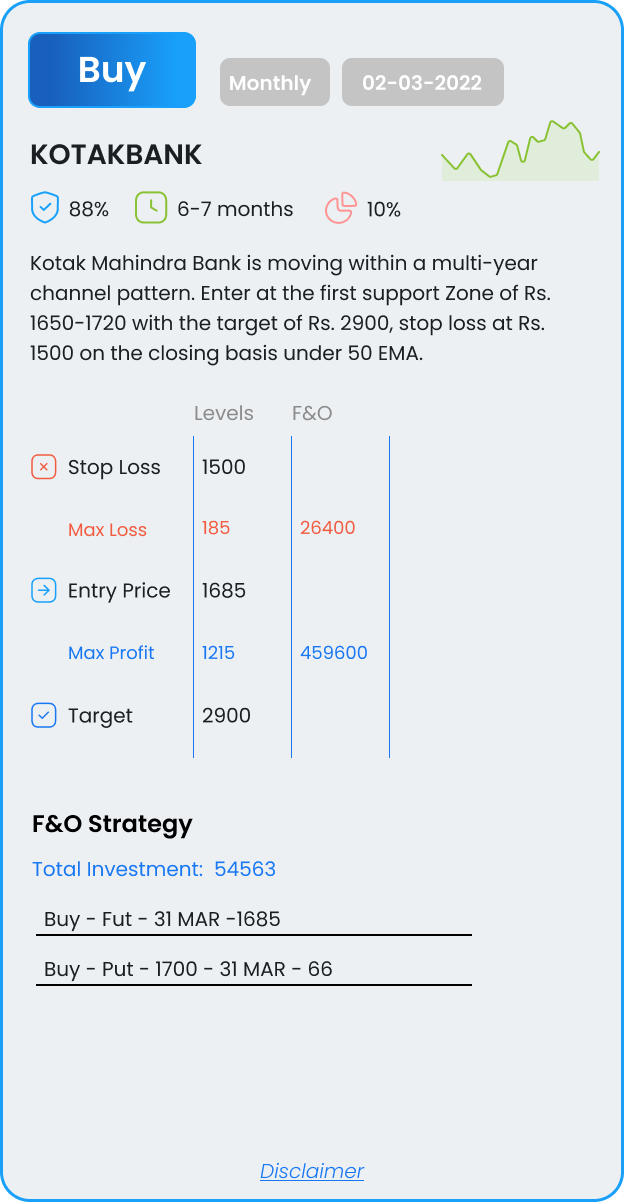

Kotak Mahindra Bank is moving within a multi-year channel pattern. Enter at the first support Zone of Rs. 1650-1720 with the target of Rs. 2900, stop loss at Rs. 1500 on the closing basis under 50 EMA.

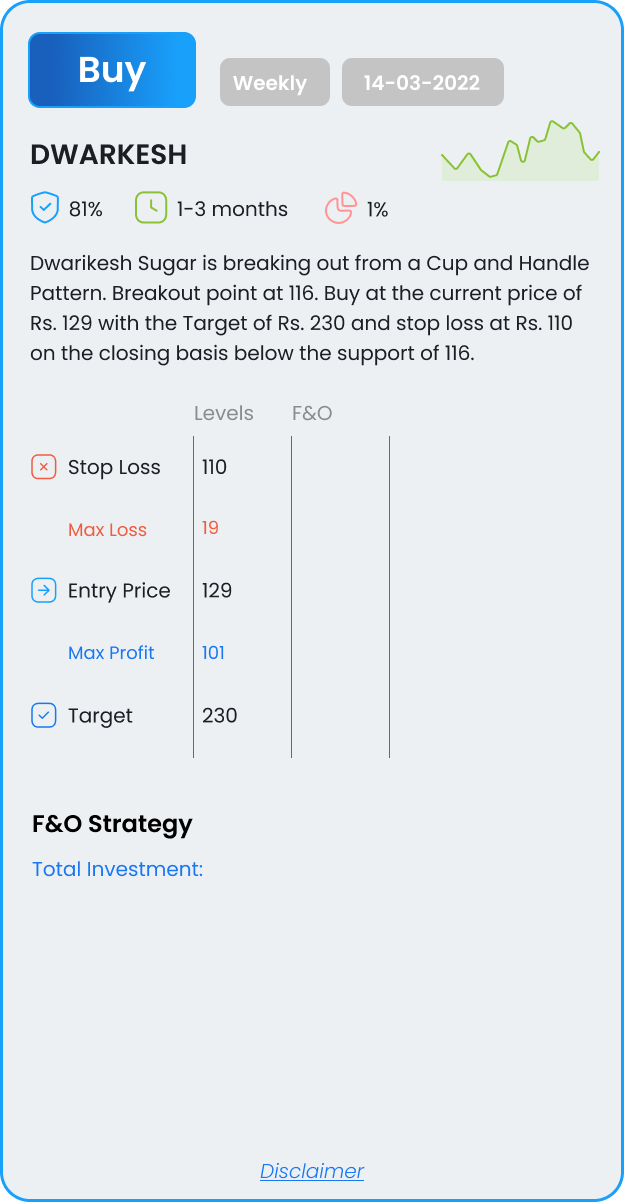

Dwarikesh Sugar is breaking out from a Cup and Handle Pattern. Breakout point at 116. Buy at the current price of Rs. 129 with the Target of Rs. 230 and stop loss at Rs. 110 on the closing basis below the support of 116.

Atul Ltd. is making a channel pattern and taking support at 50 EMA along with MACD histogram moving up. Buy at the current price of Rs. 9178 with the Target of Rs. 12600 and stop loss at Rs. 8270 on closing basis below support 1 at Rs. 8570

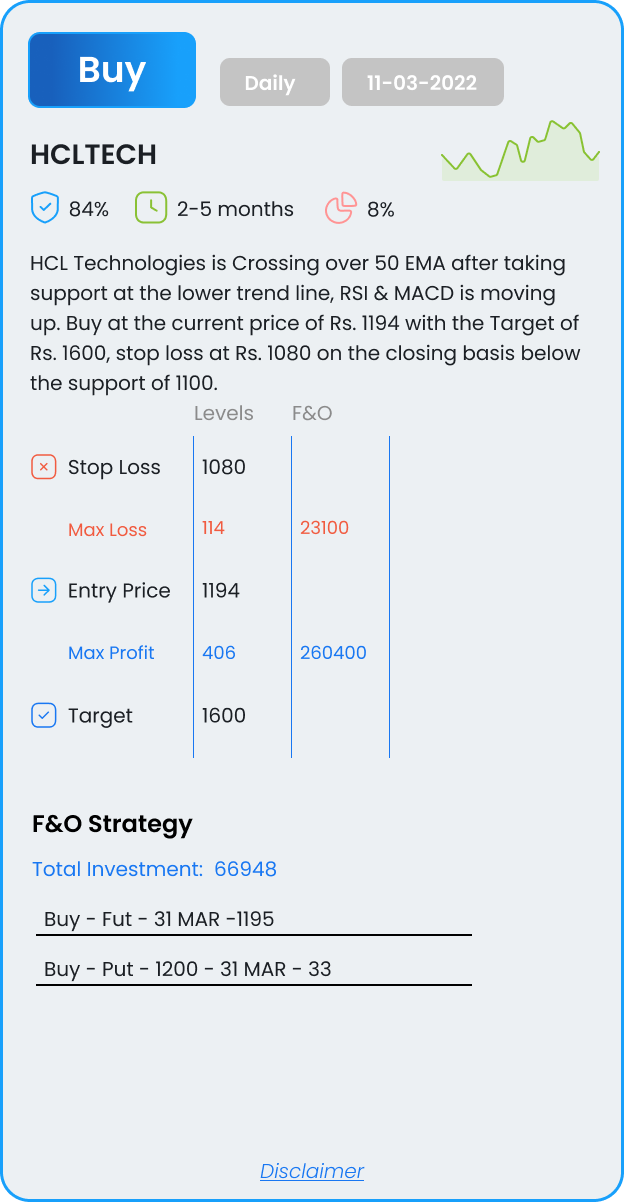

HCL Technologies is Crossing over 50 EMA after taking support at the lower trend line, RSI & MACD is moving up. Buy at the current price of Rs. 1194 with the Target of Rs. 1600, stop loss at Rs. 1080 on the closing basis below the support of 1100.

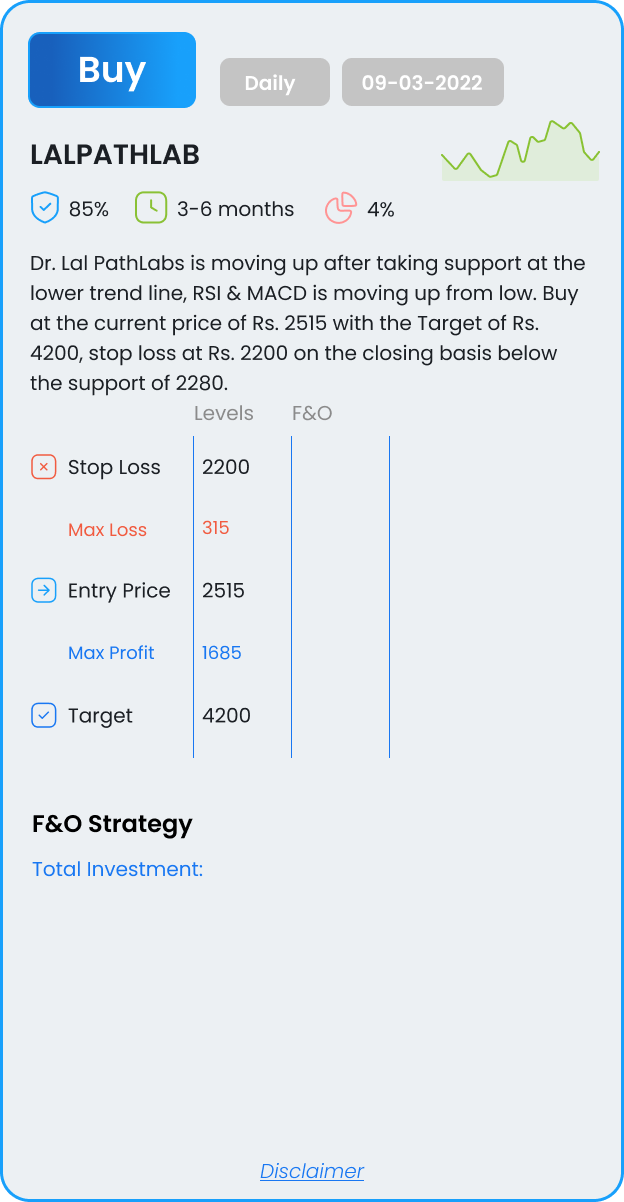

Dr. Lal PathLabs is moving up after taking support at the lower trend line, RSI & MACD is moving up from low. Buy at the current price of Rs. 2515 with the Target of Rs. 4200, stop loss at Rs. 2200 on the closing basis below the support of 2280.

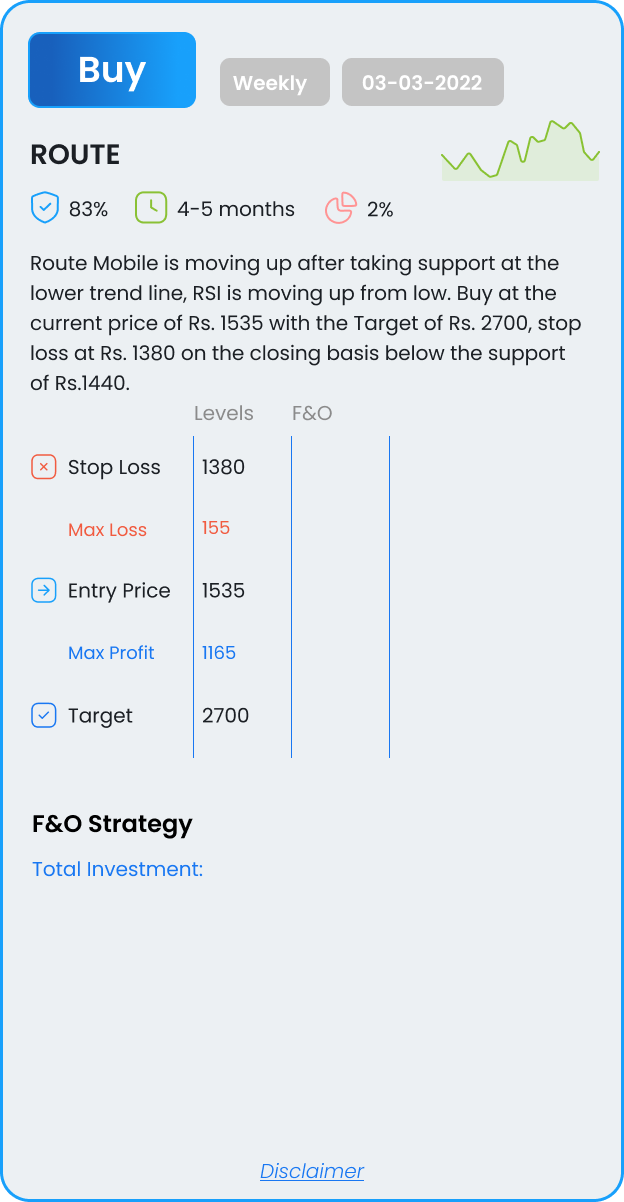

Route Mobile is moving up after taking support at the lower trend line, RSI is moving up from low. Buy at the current price of Rs. 1535 with the Target of Rs. 2700, stop loss at Rs. 1380 on the closing basis below the support of Rs.1440.

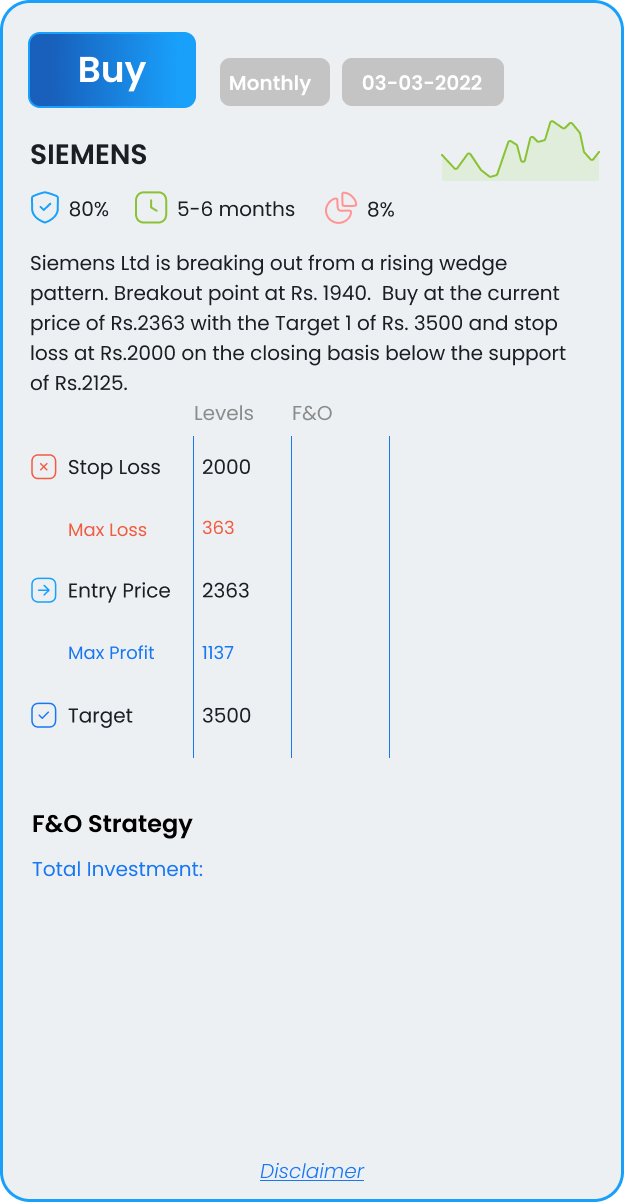

Siemens Ltd is breaking out from a rising wedge pattern. Breakout point at Rs. 1940. Buy at the current price of Rs.2363 with the Target 1 of Rs. 3500 and stop loss at Rs.2000 on the closing basis below the support of Rs.2125.

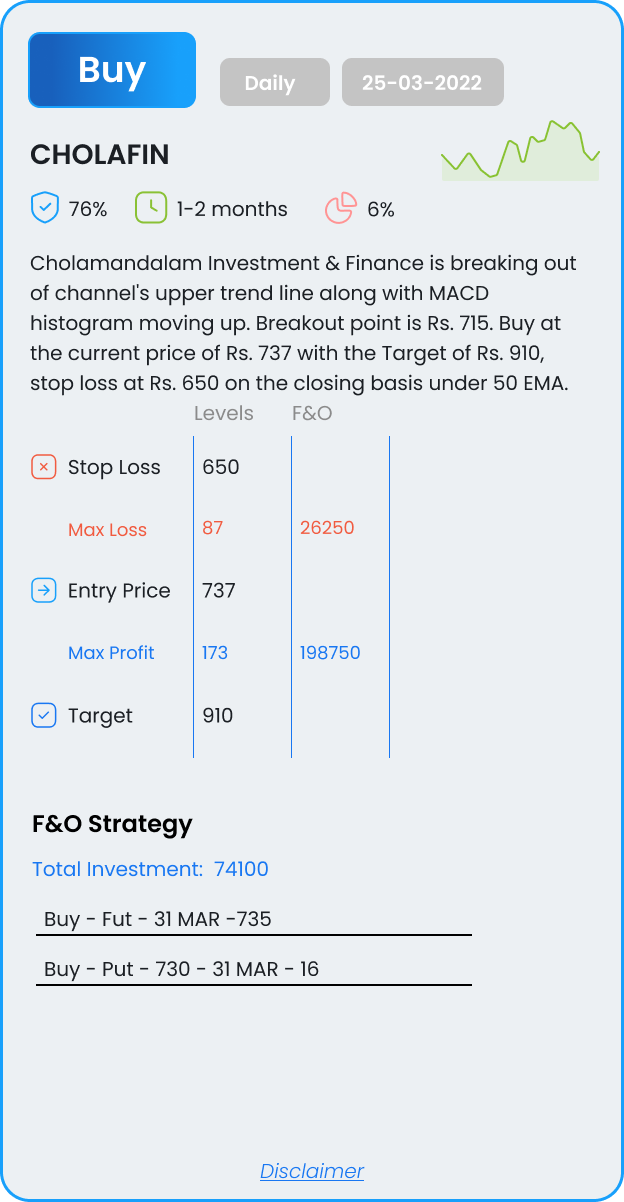

Cholamandalam Investment & Finance is breaking out of channel’s upper trend line along with MACD histogram moving up. Breakout point is Rs. 715. Buy at the current price of Rs. 737 with the Target of Rs. 910, stop loss at Rs. 650 on the closing basis under 50 EMA.