Prices for most of the consumer stocks have been skyrocketing and hitting all-time highs recently. If you open their profit and loss account, you won’t be surprised to see these ever-increasing prices are supported by the strong earnings year over year. Not only the sales have gone up, but the profit margins have also improved substantially as well. Despite everything been hunky-dory for these companies, if we observe Return on capital employed (ROCE) it’s been going down consistently.

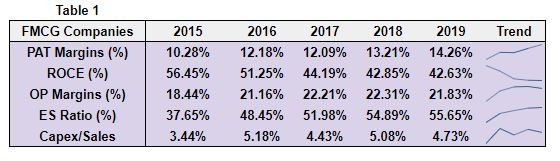

Table 1 shows aggregate ratios for 8 top consumption-based companies (likes of HUL, Marico, etc.). It can be observed that PAT Margins increased from 10.28% in 2015 to 14.26% in 2019, Operating (OP) margins increased from 18.44% in 2015 to 21.83% in 2019 though there has been a slight drop in operating profit margins in 2019 compared to 2018, that drop is not substantial. However, ROCE dropped from 56.45% in 2015 to 42.63% in 2019.

How is that possible?

To understand this phenomenon let us break down the ROCE and OP Margins into granular form.

ROCE = Net operating profits/ Capital Employed

OP Margins = Net operating profits/ Sales

Numerator is the same for both of these ratios, diverging trends in ROCE and OP margins is attributable to the two different denominators i.e Capital Employed and Sales.

For one of the ratio to fall (ROCE) and other to increase (OP Margins), the pace of increase in the denominator of one (ROCE) should surpass that of the other (OP Margins).

This indicates that the Capital Employed is increasing at a faster rate than the increment in sales. Capital Employed consists of Debt and Equity, so either Debt is increasing substantially or the Equity is increasing at a faster pace. By observing the D/E for these companies, it is observed that most of these companies are almost debt-free and for companies having some debt component, this ratio (D/E) is constantly reducing year over year.

That leaves us with only one explainable reason for the diverging trend between margins and ROCE, i.e. Shareholder’s Equity is increasing at a faster pace than sales. This can be observed from the increasing ES ratio, which is the ratio of shareholder’s equity to sales. It increased from 37.65% in 2015 to 55.65% in 2019.

So is that a good thing or a bad thing?

The business of these companies is no doubt outstanding. In fact, increasing margins shows that they have one of the best businesses possible, but the falling ROCE only indicates that the incremental earnings that they are generating, they are unable to get the same amount of return on that retained earnings.

Does that mean that these companies are paying less dividends?

If we observe dividend payout ratios for these companies, it ranges between 30%-90% which is pretty high.

What are these companies doing with the excess money on which they are unable to generate the same rate of return?

Last five years of data shows that the capital expenditure for most of them has increased substantially. So retained earnings are been used to expand their capacity in anticipation of higher demand coming ahead.

Conclusion: If the expected demand explosion theory plays out for the Indian economy, these companies with its increased capacity will effectively be able to cater to the masses with its ever expanding profit margins, which will eventually pay off heavily to its shareholders and at that point we will see ROCE turning upwards again.