We Help You Actively Invest & Trade Like A Pro Using A.I> on Tradonomy.ai

Stocks & F&O

- Access pro-research based trades

- Large universe of 1000+ stocks

- Pro-level F&O trades

No Learning Curve

- No prior knowledge required

- Easy trade features to instantly take action

Time Tested Strategies

- Built by market experts

- Ideology from 102 year Jamnadas Virji Group

- Serviced 4000+ HNI’s & top institutions

- Used by many expert traders & big market players

Who are we?

Tradonomy belongs to Jamnadas Virji Group. Jamnadas Virji is one of India's oldest investment firms catering to over 4000+ HNI clients & Top 20 institutions of India. Founded in 1919, it has weathered multiple market cycles & built wealth for its clients with its strong value systems & logical approach.

Featured in

Want to know how?

With Tradonomy's

TRADEKEYS

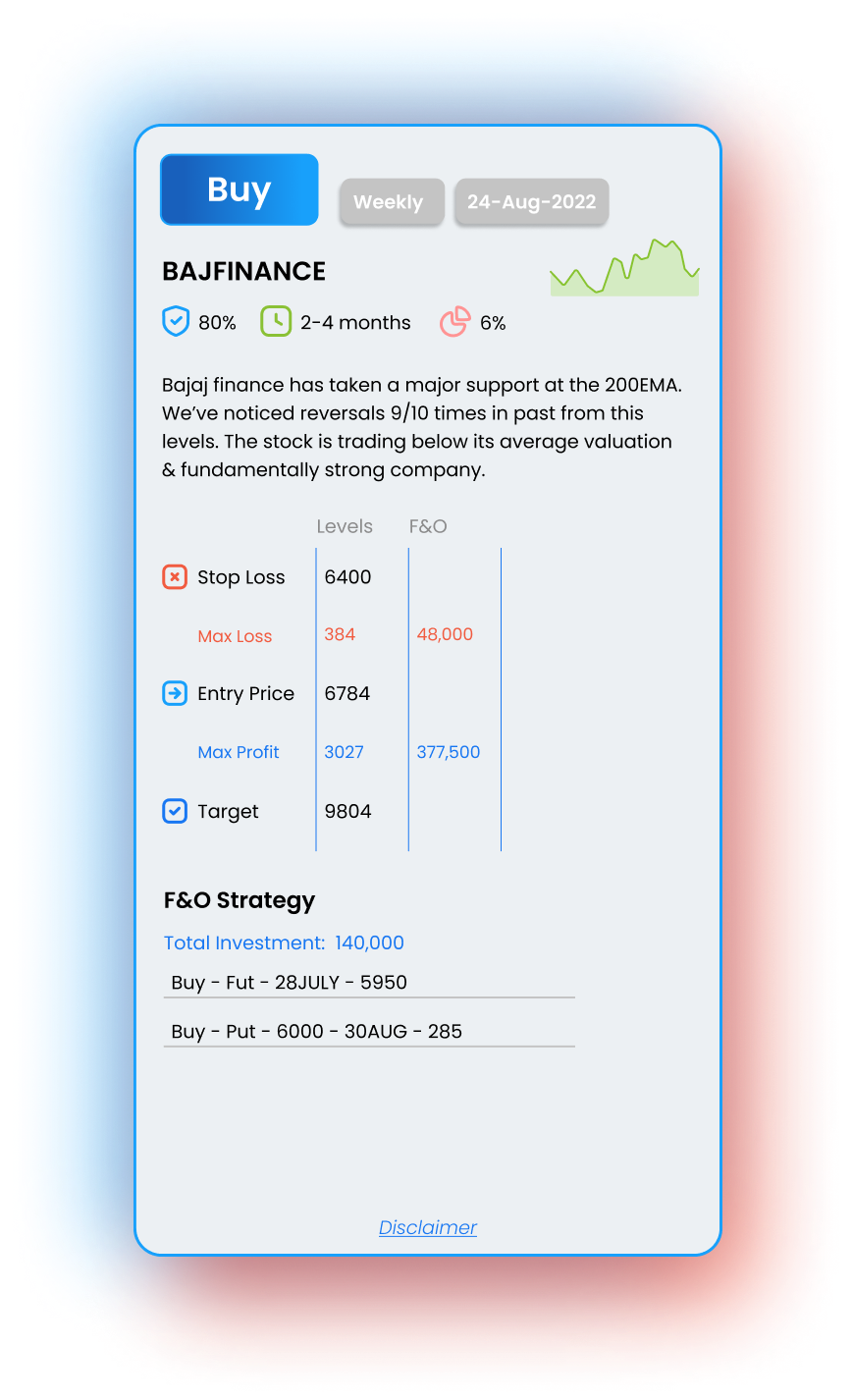

Tradekeys are logic based high potential investing opportunities powered by the tradonomy engine & easy trade features to help you take good trades quickly.

Logical explanation

A clear explanation & the analysis behind the trade.

Price levels

All important price levels like - When to buy? - When to book profit? - When to cut losses? - The maximum profit? - The maximum loss?

Average holding period

We also tell you the approximate timeframe for how long should you expect this trade to accomplish its target.

Risk based quantity

We guide as to how much of your overall capital should you invest in this particular trade. Eg: if it shows 6%, it means if you have a total investment of 10 lakhs, you can invest 60,000 on this trade.

F&O trade strategies

If this trade is F&O ready, we provide you with the best strategies you can use for this trade.

Charts & Metrics

If you're a technical analysis enthusiast, you can even view the technical setup & levels in the chart attached to this Tradekey.

be. Ahead

Top Gainers

We made 544% in Navin Fluorine

Join 1000+ Tradonomy Traders

Join our clan of happy traders that unlocked the secret of pro-trading!

Logical, realistic, safe & effective! Each tradekey is exciting, I'm always waiting for what's next!

Top Recent Performers

Pro-Premium

Exclusive access to Tradonomy.AI for 1 Year & lots more!-

Access to Tradonomy.AI

-

On-Demand stock analysis [ 3 / month]

-

In-depth portfolio analysis

-

Tradekeys with F&O support

-

Expert chat support

Top Gainers

We made 267% in Tata Chemicals

How are these tradekeys generated?

The Art Of Pro-Trading & Investing

be. Clever

Top Gainers

We made 154% in KEI Industries

How does the tradonomy engine work?

The Tradonomy Engine

Tap the dots below to see a short brief on how the Tradonomy Engine works

Business Quality & Intensive Fundamental Research. With 16,000+ Data Points, Unique Ratios, 3 Valuation Methodologies.

Comparative Research to find the best bets within same industries, business house, size of company & many other such categories. We use a blend of fundamental & technical analysis.

Trend & Technical Research to find the best trading setups & capture high potential breakout patterns.

A.I. models of all trends using statistical parameters like mean reversion, R factor, predictive analysis etc. to make sure we can capture trades more efficiently.

Tradonomy engine generates & processes 5+ million data points every week & using expensive softwares & built-in technologies.

Top Gainers

We made 125% in Permanent Magnets

Our performance

Let's explore how one of subscribers is using tradonomy to trade successfully

46

Total trades taken since subscribed 6 Months back

34,000

Average investment / trade

60%

Trades have hit targets & 40% trades have hit stop loss.

2.5 x

Profit made in winning trades compared to losses made in losing trades

6.11 Lakhs

Overall net profit has been 61% until date including the losses & other charges.

100%

Confident trader with no learning curve. Only tradonomy + patience.

Tradonomy Success Stories

Success stories shared by our subscribers!

Don't miss out on winning trades

Start Investing Like A Pro

In 3 Easy Steps

Top Gainers

We made 136% in BHEL

What more will I get?

The Full Active Investing & Trading Package

be. Ready-To-Strike

Unlock your pro-package

The 4 Golden Rules

Pro-Traders use these 4 golden rules to ensure sustainable profits & minimize risk!

be. Confident

Top Gainers

We made 109% in Linde India

Get expert opinion for your stocks

OUR TEAM CONSISTS OF

The Tradonmists

Research Analysts

Market Experts

Derivative Experts

Chartered Accountants & CFA's

Stock Brokers

Tech Enthusiasts

LED BY

Our Leaders

FAQ

Frequently asked questions (FAQ) or Questions and Answers (Q&A), are listed questions and answers, all supposed to be commonly.

They’re like the tesla of the trading world! Tradekeys contain actionable trade details which guide you through key factors like when to buy, when to sell, the max risk, the max profit, how much to buy etc. They’re what experts use for trading.

You might not receive trade keys everyday, or you might get a few in a day. This is purely depending on the market opportunities.

Although you can start with as much as Rs. 5,000/- but we recommend to have at least Rs. 50,000/- to begin with. This will ensure you participate in a disciplined manner for all the trade keys given.

Yes, not every trade can be profitable, even investors like Warren Buffet & Rakesh Jhunjhunwala lose money on 30%-40% of trades. Stop losses help protect capital & allow us to recover the loss from future trades which is crucial for a successful trading journey. With Tradonomy, our job is to make sure that you win at least 2x more than the losing ones

Every trade key comes with a confidence ratio. This ratio accounts for all the factors including fundamental quality, technical pattern strength, stock volatility, etc. that could make a trade a winner. Higher confidence ratio indicates higher probability of a trade to move as expected.

Risk-Reward Ratio simply tells you how much profit you can potentially make against how much risk you’re taking. Eg: if you invest 10,000 in a trade and downside indicates a 2000 loss, but upside indicates a 4000 profit, that means for a risk of losing 2000 but you can benefit 2x that at 4000, making your risk-return at 1:2 or 2x.

Ideally tradekeys are designed in a way that the targets are achieved most of the time, but if the trade has given closer to 90% of the expected move then booking out the profits wouldn’t be a bad idea. Example- If as per the trade key, target for a trade is a profit of ₹500 per share, and when the trade is almost ₹450 per share in profit (90% of ₹500), then booking profits could be considered.

Yes, we will notify you instantly through the communication channels about any activity such as entry, exit, shuffle, build-up, trim down, and more!

It is not necessary to take all the trades, you can take trades according to your comfort & confidence, but don’t miss too many as the probability works in your favor when you’re in the game.

Tradonomy engine comprises various interlinked parts like fundamental analysis, technical analysis & statistical analysis which is further scanned, analyzed & validated by experts belonging to 100+ years of legacy, core values & deep analysis.

We follow a 360 degree approach for investing so yes long term ideas are a part of wealth building & Tradonomy engine explores every opportunity. Watchout for our articles & other cool sections.

Tradonomy is not a PMS service but it works better than that, since you are in control of every decision making along with the power of deep research and valuable data to help you make those decisions. We know that nobody loves your money better than you!

Nope, but we’ll make sure it never comes to that.

Depends on how far are you from the given entry price & the nearest target or stop loss.

Absolutely. When it comes to stop losses, there is no flexibility. Just exit like there’s a fire in the building.

Not at all, just get started. It’s fun, exciting and money making.

Absolutely not, that’s what Tradonomy is for. You will straight get actionable insights which require no prior knowledge of technical analysis. But we are sure that with Tradonomy you’ll learn a lot more than only technical analysis

Let's Connect

Don't miss out, Stay updated

Don’t hesitate to subscribe to decoding news, companies & interesting trade setups to become successful traders

SEBI Registered Research Analyst Firm : Registration No: INH000006697